automated portfolio 2025-11-12T17:33:15Z

-

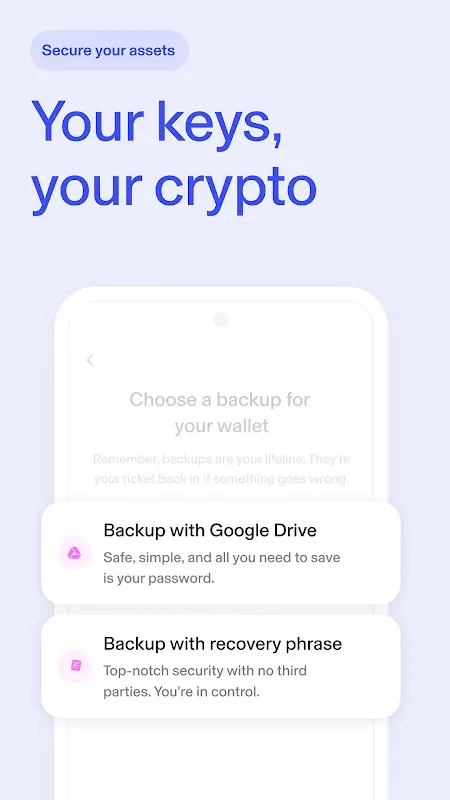

Rain lashed against my office window as the crypto charts bled crimson across three different screens. My fingers trembled - not from the caffeine, but from the sickening realization that my fragmented portfolio was hemorrhaging value while I struggled to move assets between chains. That Tuesday afternoon crash wasn't just numbers dipping; it felt like watching sand slip through clenched fists. I'd built this elaborate Rube Goldberg machine of wallet apps: MetaMask for Ethereum, Phantom for Sola

Rain lashed against my office window as the crypto charts bled crimson across three different screens. My fingers trembled - not from the caffeine, but from the sickening realization that my fragmented portfolio was hemorrhaging value while I struggled to move assets between chains. That Tuesday afternoon crash wasn't just numbers dipping; it felt like watching sand slip through clenched fists. I'd built this elaborate Rube Goldberg machine of wallet apps: MetaMask for Ethereum, Phantom for Sola -

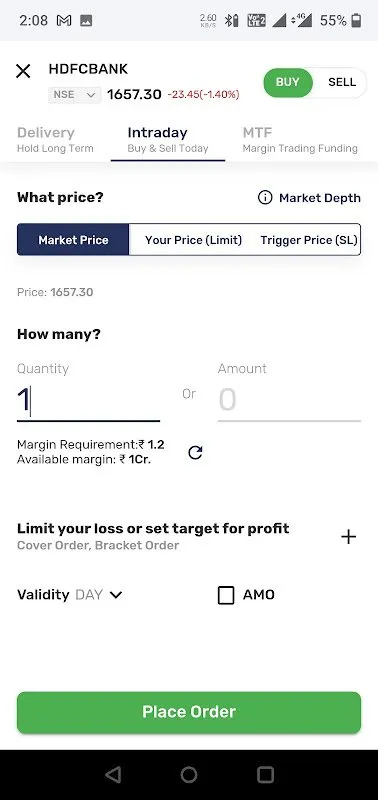

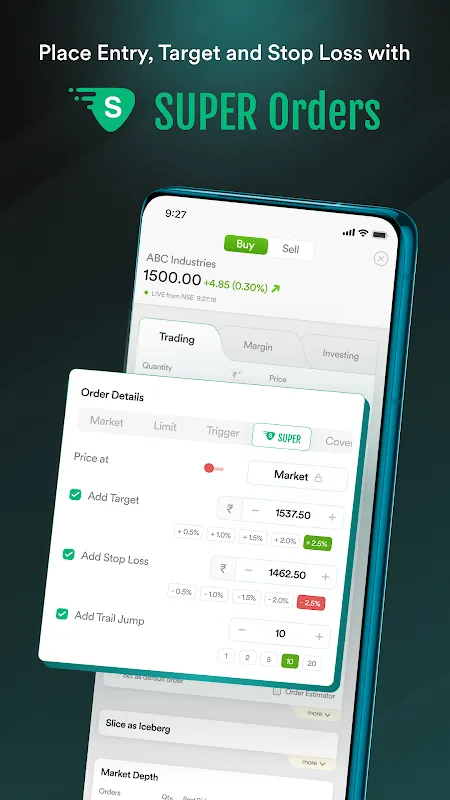

Sweat pooled at my collar as my old trading app's chart flickered like a dying candle during the Nifty volatility spike. Three percentage points vanished in the lag between my sell order and its glacial execution - another lunchtime trading disaster. That evening, I downloaded GCL Trade+ out of sheer desperation, not expecting much from yet another "revolutionary platform." The next morning's RBI announcement became my trial by fire. As bond yield fluctuations lit up the screen, my thumb flew ac

Sweat pooled at my collar as my old trading app's chart flickered like a dying candle during the Nifty volatility spike. Three percentage points vanished in the lag between my sell order and its glacial execution - another lunchtime trading disaster. That evening, I downloaded GCL Trade+ out of sheer desperation, not expecting much from yet another "revolutionary platform." The next morning's RBI announcement became my trial by fire. As bond yield fluctuations lit up the screen, my thumb flew ac -

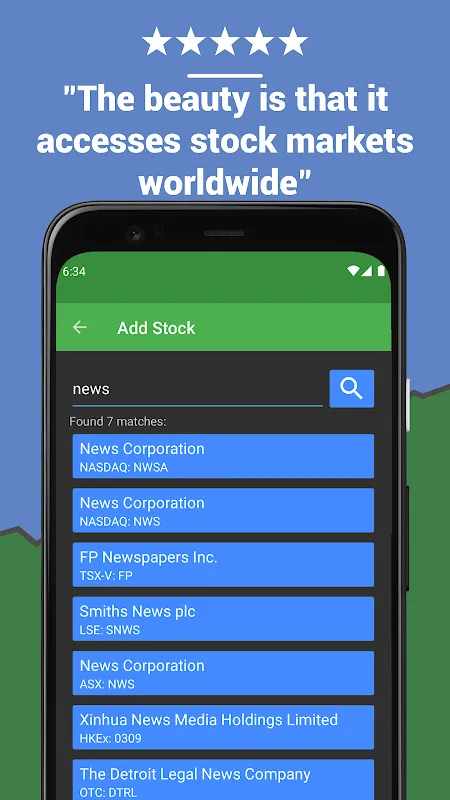

My knuckles turned bone-white gripping the phone as my old trading platform stuttered - frozen on a sell confirmation screen while Tesla shares plummeted 3% in pre-market. That metallic taste of panic flooded my mouth as frantic swiping yielded only spinning wheels. Three hundred grand evaporating because some garbage app couldn't handle volatility. Right then, my broker pinged: "Get QuickStocks or get margin called."

My knuckles turned bone-white gripping the phone as my old trading platform stuttered - frozen on a sell confirmation screen while Tesla shares plummeted 3% in pre-market. That metallic taste of panic flooded my mouth as frantic swiping yielded only spinning wheels. Three hundred grand evaporating because some garbage app couldn't handle volatility. Right then, my broker pinged: "Get QuickStocks or get margin called." -

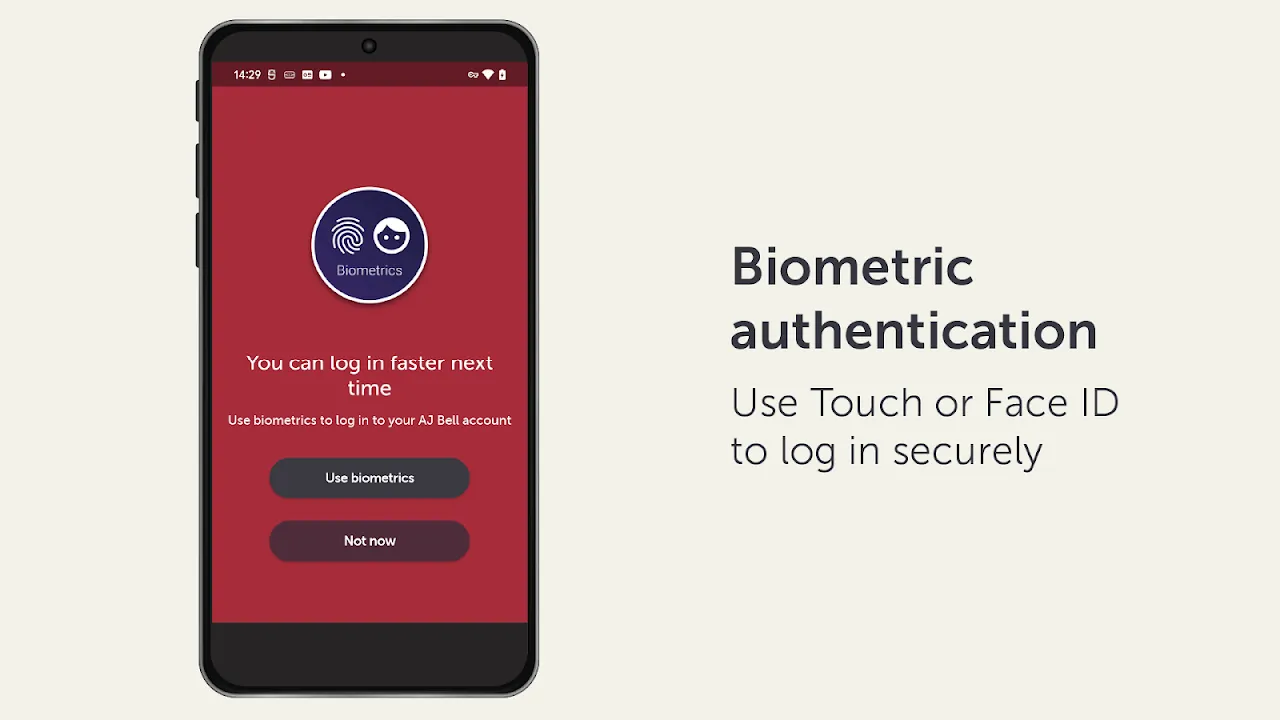

The morning dew still clung to the grass when my phone vibrated violently against the wrought-iron bench. I’d been watching sparrows fight over crumbs, trying to forget the red arrows bleeding across global markets overnight. But there it was—AJ Bell’s push notification screaming that my energy stock had nosedived 14% before London even yawned awake. My thumbprint unlocked chaos: jagged crimson charts, frantic order books, and that sickening pit in my stomach when paper wealth evaporates. No Blo

The morning dew still clung to the grass when my phone vibrated violently against the wrought-iron bench. I’d been watching sparrows fight over crumbs, trying to forget the red arrows bleeding across global markets overnight. But there it was—AJ Bell’s push notification screaming that my energy stock had nosedived 14% before London even yawned awake. My thumbprint unlocked chaos: jagged crimson charts, frantic order books, and that sickening pit in my stomach when paper wealth evaporates. No Blo -

Rain lashed against the window as I hunched over my phone at 3 AM, the blue glow reflecting in tired eyes. For fifteen years, I'd tracked every throw, every yard, every heartbeat of Marcus Riley's career - from college underdog to NFL starter. But tonight felt different. My knuckles whitened around the device as I watched his stock nosedive on PredictionStrike after that interception. This wasn't fantasy football points vanishing into ether; my actual grocery money evaporated with each percentag

Rain lashed against the window as I hunched over my phone at 3 AM, the blue glow reflecting in tired eyes. For fifteen years, I'd tracked every throw, every yard, every heartbeat of Marcus Riley's career - from college underdog to NFL starter. But tonight felt different. My knuckles whitened around the device as I watched his stock nosedive on PredictionStrike after that interception. This wasn't fantasy football points vanishing into ether; my actual grocery money evaporated with each percentag -

Rain blurred my office window as notifications screamed disaster. Bitcoin nosedived 20% overnight, triggering margin calls across my dashboard. My usual exchange choked – frozen charts, unresponsive buttons. I slammed my fist on the desk, coffee sloshing over tax documents. Years of gains were evaporating while some server farm slept. Then it hit me: that blue icon recently installed but untouched. Three frantic taps launched CoinJar, its interface appearing like calm waters in a hurricane.

Rain blurred my office window as notifications screamed disaster. Bitcoin nosedived 20% overnight, triggering margin calls across my dashboard. My usual exchange choked – frozen charts, unresponsive buttons. I slammed my fist on the desk, coffee sloshing over tax documents. Years of gains were evaporating while some server farm slept. Then it hit me: that blue icon recently installed but untouched. Three frantic taps launched CoinJar, its interface appearing like calm waters in a hurricane. -

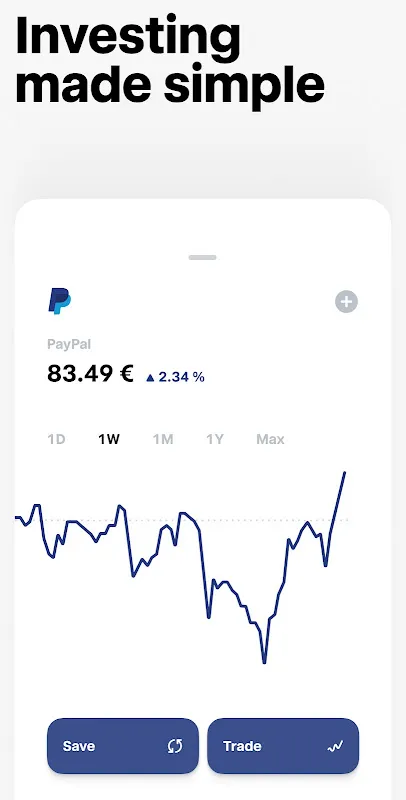

Rain lashed against the window as I stared at the spreadsheet – columns bleeding red across three different brokerage dashboards. My fingers trembled not from caffeine, but from the sickening realization that I’d just missed a 12% overnight surge on NVIDIA shares. Again. Why? Because my "efficient" system involved checking Firstrade for U.S. stocks, Revolut for European ETFs, and a local broker for bonds. Each login required unique authentication nonsense; each platform updated prices at glacial

Rain lashed against the window as I stared at the spreadsheet – columns bleeding red across three different brokerage dashboards. My fingers trembled not from caffeine, but from the sickening realization that I’d just missed a 12% overnight surge on NVIDIA shares. Again. Why? Because my "efficient" system involved checking Firstrade for U.S. stocks, Revolut for European ETFs, and a local broker for bonds. Each login required unique authentication nonsense; each platform updated prices at glacial -

Kristal: Digital Wealth ManagerSearching for trending investments from around the world? They\xe2\x80\x99re all on\xc2\xa0Kristal.AI.Now with a brand new look and feel!We offer a vast range of investments for Accredited Investors. From award-winning funds to alternative and impact investments, and p

Kristal: Digital Wealth ManagerSearching for trending investments from around the world? They\xe2\x80\x99re all on\xc2\xa0Kristal.AI.Now with a brand new look and feel!We offer a vast range of investments for Accredited Investors. From award-winning funds to alternative and impact investments, and p -

tradegate.direct \xe2\x80\x93 Trading-Apptradegate.direct \xe2\x80\x93 Real stock market trading. Direct. Free.Ambitious traders trade with us without any detours \xe2\x80\x93 directly on the Tradegate Exchange, Europe's most liquid retail exchange.Our trading app is your tool for direct stock marke

tradegate.direct \xe2\x80\x93 Trading-Apptradegate.direct \xe2\x80\x93 Real stock market trading. Direct. Free.Ambitious traders trade with us without any detours \xe2\x80\x93 directly on the Tradegate Exchange, Europe's most liquid retail exchange.Our trading app is your tool for direct stock marke -

FUNDtastic - Wealth PlatformFUNDtastic is an investment application for passive investors to grow wealth sustainably, safely and easily. In the FUNDtastic application, various investment instruments such as gold and mutual funds are available which are specially curated to achieve your financial goa

FUNDtastic - Wealth PlatformFUNDtastic is an investment application for passive investors to grow wealth sustainably, safely and easily. In the FUNDtastic application, various investment instruments such as gold and mutual funds are available which are specially curated to achieve your financial goa -

GS PWMAccess your Goldman Sachs account anytime on the new GS PWM app. Available for Goldman Sachs Private Wealth Management (PWM) and Goldman Sachs Ayco clients, GS PWM allows you to view your portfolio, contact your team, and keep up with the latest market insights.\xe2\x80\x8b\xe2\x80\x8bDepending on whether you're a PWM or Goldman Sachs Ayco client and the type of services provided to you, you may have access to:\xe2\x80\xa2 See your accounts market value, investment results, available cash

GS PWMAccess your Goldman Sachs account anytime on the new GS PWM app. Available for Goldman Sachs Private Wealth Management (PWM) and Goldman Sachs Ayco clients, GS PWM allows you to view your portfolio, contact your team, and keep up with the latest market insights.\xe2\x80\x8b\xe2\x80\x8bDepending on whether you're a PWM or Goldman Sachs Ayco client and the type of services provided to you, you may have access to:\xe2\x80\xa2 See your accounts market value, investment results, available cash -

M1: Invest & Bank SmarterM1: Sophisticated wealth-building, simplified.Meet M1: The Finance Super App\xc2\xae, where you can earn, invest and borrow\xe2\x80\x94all in one place. Join hundreds of thousands of investors who trust us with more than $10 billion in assets.EARN\xe2\x80\xa2\tOptimize cash

M1: Invest & Bank SmarterM1: Sophisticated wealth-building, simplified.Meet M1: The Finance Super App\xc2\xae, where you can earn, invest and borrow\xe2\x80\x94all in one place. Join hundreds of thousands of investors who trust us with more than $10 billion in assets.EARN\xe2\x80\xa2\tOptimize cash -

Risevest: Invest in DollarsBeginner or an expert, Rise offers an intuitive and easy way to invest in global dollar denominated assets that beats inflation. Risevest has taken away everything you don't need \xe2\x80\x94 the commissions on every click and investing jargons, like life isn\xe2\x80\x99t

Risevest: Invest in DollarsBeginner or an expert, Rise offers an intuitive and easy way to invest in global dollar denominated assets that beats inflation. Risevest has taken away everything you don't need \xe2\x80\x94 the commissions on every click and investing jargons, like life isn\xe2\x80\x99t -

Scripbox: Mutual Fund & SIPScripbox is a mutual funds and SIP (Systematic Investment Plan) app designed to assist users in managing their investments effectively. This application provides a streamlined platform for users to invest in a diverse range of mutual fund schemes, making it a useful tool f

Scripbox: Mutual Fund & SIPScripbox is a mutual funds and SIP (Systematic Investment Plan) app designed to assist users in managing their investments effectively. This application provides a streamlined platform for users to invest in a diverse range of mutual fund schemes, making it a useful tool f -

The airplane cabin hummed with that particular brand of exhausted silence that comes with a red-eye flight. I was somewhere over the Atlantic, trying to sleep, when my phone buzzed with an urgency that cut through the drone of engines. It wasn't a text. It was a notification from Rii DIVYESH J. RACH, an app I’d downloaded on a whim a month prior. The screen glowed in the dark: "Unusual activity detected in your tech ETF holdings." My stomach dropped. Unusual? At 3 a.m. GMT? This was not part of

The airplane cabin hummed with that particular brand of exhausted silence that comes with a red-eye flight. I was somewhere over the Atlantic, trying to sleep, when my phone buzzed with an urgency that cut through the drone of engines. It wasn't a text. It was a notification from Rii DIVYESH J. RACH, an app I’d downloaded on a whim a month prior. The screen glowed in the dark: "Unusual activity detected in your tech ETF holdings." My stomach dropped. Unusual? At 3 a.m. GMT? This was not part of -

That Tuesday morning smelled like burnt coffee and panic. My palms stuck to the mouse as AAPL earnings volatility spiked 300% overnight. The iron condor I'd carefully built was hemorrhaging money faster than I could refresh my broker's app. Sweat trickled down my temple as gamma exposure flipped against me - $12,000 unrealized loss blinking like a neon tombstone. In that suffocating moment, I fumbled for my phone and opened the tool that would rewrite my trading psychology.

That Tuesday morning smelled like burnt coffee and panic. My palms stuck to the mouse as AAPL earnings volatility spiked 300% overnight. The iron condor I'd carefully built was hemorrhaging money faster than I could refresh my broker's app. Sweat trickled down my temple as gamma exposure flipped against me - $12,000 unrealized loss blinking like a neon tombstone. In that suffocating moment, I fumbled for my phone and opened the tool that would rewrite my trading psychology. -

My palms were slick against the glass of my fourth coffee mug that Tuesday morning when the Swiss National Bank dropped their bombshell. Bloomberg Terminal flickered uselessly across three monitors while Twitter screamed conflicting interpretations. That's when L Echo vibrated against my mahogany desk with surgical precision: unpegged CHF cap triggers 30% EURCHF plunge. Before CNBC's anchor spilled her latte on air, I'd already triggered stop-loss orders across five client accounts. The app's vi

My palms were slick against the glass of my fourth coffee mug that Tuesday morning when the Swiss National Bank dropped their bombshell. Bloomberg Terminal flickered uselessly across three monitors while Twitter screamed conflicting interpretations. That's when L Echo vibrated against my mahogany desk with surgical precision: unpegged CHF cap triggers 30% EURCHF plunge. Before CNBC's anchor spilled her latte on air, I'd already triggered stop-loss orders across five client accounts. The app's vi -

Rain lashed against my apartment windows that Tuesday night, mirroring the storm inside my trading account. Ethereum had just nosedived 18% in twenty minutes, erasing three months of gains. My fingers trembled over the sell button - that primal panic every crypto trader knows. Then my phone buzzed with an urgency that cut through the chaos. The notification wasn't some generic "market down" alert; it pinpointed liquidation clusters forming below $1,740 with timestamped precision. This wasn't jus

Rain lashed against my apartment windows that Tuesday night, mirroring the storm inside my trading account. Ethereum had just nosedived 18% in twenty minutes, erasing three months of gains. My fingers trembled over the sell button - that primal panic every crypto trader knows. Then my phone buzzed with an urgency that cut through the chaos. The notification wasn't some generic "market down" alert; it pinpointed liquidation clusters forming below $1,740 with timestamped precision. This wasn't jus -

My knuckles were white around the phone, sweat smearing across the screen as NASDAQ futures nosedived. That crimson -3% glare felt like a physical punch while my old brokerage's spinning wheel mocked me - frozen mid-swipe as thousands evaporated. I'd begged the unresponsive app like a prayer, fingernails tapping maniacally against cracked glass while stop-loss orders dissolved into digital ether. That sickening helplessness haunted me for weeks; the phantom vibration of delayed notifications jol

My knuckles were white around the phone, sweat smearing across the screen as NASDAQ futures nosedived. That crimson -3% glare felt like a physical punch while my old brokerage's spinning wheel mocked me - frozen mid-swipe as thousands evaporated. I'd begged the unresponsive app like a prayer, fingernails tapping maniacally against cracked glass while stop-loss orders dissolved into digital ether. That sickening helplessness haunted me for weeks; the phantom vibration of delayed notifications jol -

Rain lashed against the tent fabric like impatient fingers drumming, each drop echoing my rising panic. Deep in the Scottish Highlands with barely two signal bars, my phone suddenly screamed with a sound I'd programmed only for market emergencies – a shrill, persistent siren cutting through the storm's roar. Weeks prior, I'd set Bitkub's price alert for an obscure DeFi token while sipping coffee in Bangkok, never imagining I'd need to act on it while knee-deep in heather. My fingers trembled as

Rain lashed against the tent fabric like impatient fingers drumming, each drop echoing my rising panic. Deep in the Scottish Highlands with barely two signal bars, my phone suddenly screamed with a sound I'd programmed only for market emergencies – a shrill, persistent siren cutting through the storm's roar. Weeks prior, I'd set Bitkub's price alert for an obscure DeFi token while sipping coffee in Bangkok, never imagining I'd need to act on it while knee-deep in heather. My fingers trembled as