financial reconciliation 2025-11-14T19:31:46Z

-

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years -

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban -

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism.

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism. -

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone -

Thirty nautical miles offshore with nothing but indigo waves stretching to the horizon, I discovered the anchor chain had sawed through the bow roller during the night storm. Salt crusted my lips as I surveyed the damage - not just to the boat, but to my carefully planned circumnavigation budget. The Croatian marina manager's ultimatum crackled through the satellite phone: "Pay 80% deposit by noon or we give your berth to charter fleet." My stomach dropped like a lead weight. Banks? Closed for S

Thirty nautical miles offshore with nothing but indigo waves stretching to the horizon, I discovered the anchor chain had sawed through the bow roller during the night storm. Salt crusted my lips as I surveyed the damage - not just to the boat, but to my carefully planned circumnavigation budget. The Croatian marina manager's ultimatum crackled through the satellite phone: "Pay 80% deposit by noon or we give your berth to charter fleet." My stomach dropped like a lead weight. Banks? Closed for S -

The microwave beeped at 2 AM, echoing through my empty apartment as I stared at another ramen dinner. My phone buzzed with a payment declined notification - third time this week. I could taste the salt of cheap noodles and desperation. That's when Sarah from the credit union slid a pamphlet across her desk. "Try this," she said, "it'll hurt less than actual bankruptcy." I scoffed, but that night, with eviction notices looming, I downloaded Bite of Reality 2. What followed wasn't just education;

The microwave beeped at 2 AM, echoing through my empty apartment as I stared at another ramen dinner. My phone buzzed with a payment declined notification - third time this week. I could taste the salt of cheap noodles and desperation. That's when Sarah from the credit union slid a pamphlet across her desk. "Try this," she said, "it'll hurt less than actual bankruptcy." I scoffed, but that night, with eviction notices looming, I downloaded Bite of Reality 2. What followed wasn't just education; -

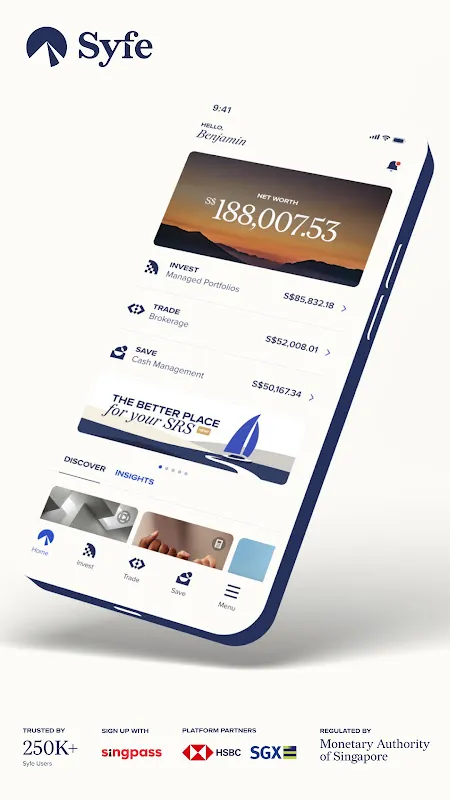

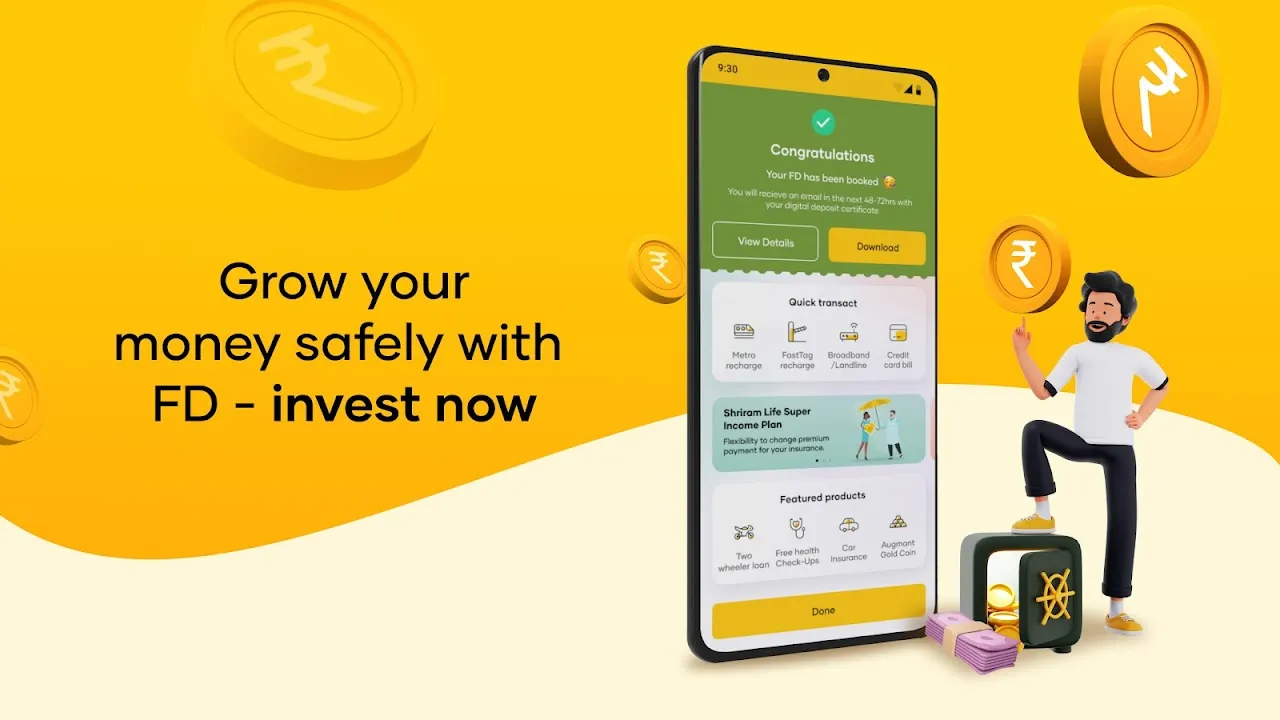

Rain lashed against the window as I stared at the spreadsheet mocking me from my screen. Another month, another paycheck devoured by bills while my savings stagnated. That gnawing realization hit like physical pain - my money was dying a slow death in that 0.05% interest account while inflation laughed at my financial illiteracy. I'd tried brokerage apps before, but staring at complex charts felt like deciphering alien hieroglyphs after 10-hour coding marathons. My attempt at stock picking ended

Rain lashed against the window as I stared at the spreadsheet mocking me from my screen. Another month, another paycheck devoured by bills while my savings stagnated. That gnawing realization hit like physical pain - my money was dying a slow death in that 0.05% interest account while inflation laughed at my financial illiteracy. I'd tried brokerage apps before, but staring at complex charts felt like deciphering alien hieroglyphs after 10-hour coding marathons. My attempt at stock picking ended -

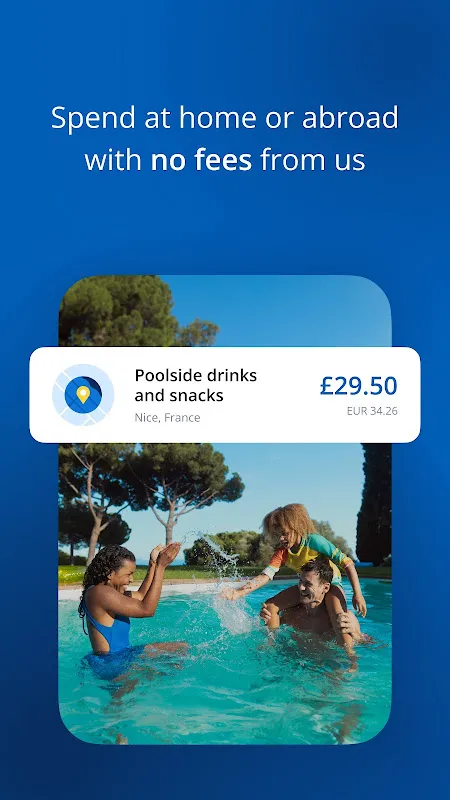

The scent of burnt spices still clung to my clothes as I stood frozen in the dimly lit alley, fingers trembling against my phone screen. My wallet had just been lifted in the Jemaa el-Fnaa chaos, leaving me with nothing but a drained local SIM and 37% battery. Panic tasted like copper as I frantically swiped between banking apps - each demanding separate authentication, each mocking me with loading wheels. My savings account demanded fingerprint verification while the travel card app insisted on

The scent of burnt spices still clung to my clothes as I stood frozen in the dimly lit alley, fingers trembling against my phone screen. My wallet had just been lifted in the Jemaa el-Fnaa chaos, leaving me with nothing but a drained local SIM and 37% battery. Panic tasted like copper as I frantically swiped between banking apps - each demanding separate authentication, each mocking me with loading wheels. My savings account demanded fingerprint verification while the travel card app insisted on -

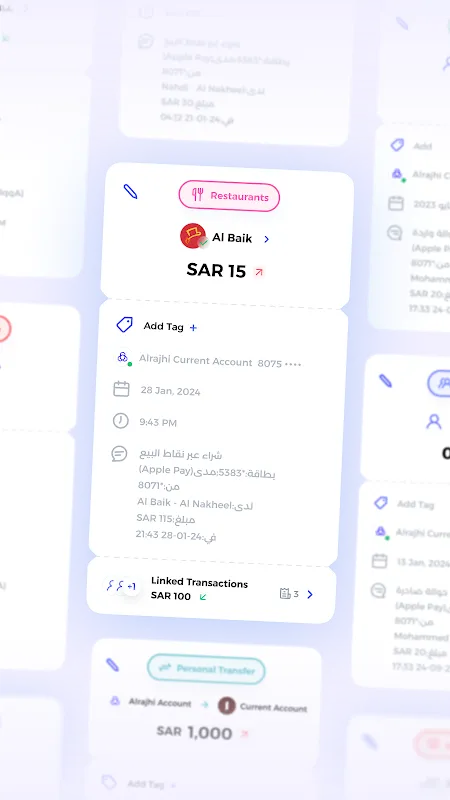

That piercing notification sound still haunts me - the overdraft alert vibrating through my phone at 3 AM. My throat tightened as I scrambled between four banking apps, fingers trembling against the cold screen. "Where did it go?" I whispered to the darkness, mentally retracing coffee runs and impulse purchases. The numbers blurred into meaningless digits until I accidentally opened this money command hub. Within seconds, crimson expense categories glared back: 47% on food delivery, 12% on forgo

That piercing notification sound still haunts me - the overdraft alert vibrating through my phone at 3 AM. My throat tightened as I scrambled between four banking apps, fingers trembling against the cold screen. "Where did it go?" I whispered to the darkness, mentally retracing coffee runs and impulse purchases. The numbers blurred into meaningless digits until I accidentally opened this money command hub. Within seconds, crimson expense categories glared back: 47% on food delivery, 12% on forgo -

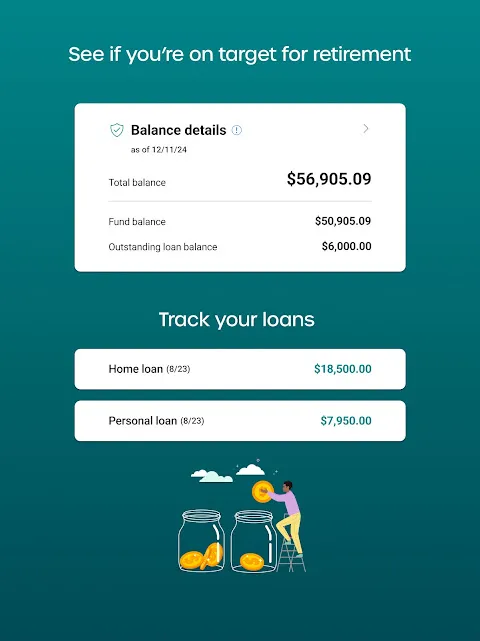

Rain lashed against my bedroom window at 2:37 AM when the notification buzzed violently under my pillow. Stock futures were cratering 800 points. That acidic dread flooded my throat - the kind that tastes like copper pennies and regret. My IRA had already bled 11% this quarter. In the suffocating dark, I fumbled for my phone, cold sweat making the screen slip through my trembling fingers. Three failed password attempts later, I nearly spiked the damn thing against the wall. Then I remembered the

Rain lashed against my bedroom window at 2:37 AM when the notification buzzed violently under my pillow. Stock futures were cratering 800 points. That acidic dread flooded my throat - the kind that tastes like copper pennies and regret. My IRA had already bled 11% this quarter. In the suffocating dark, I fumbled for my phone, cold sweat making the screen slip through my trembling fingers. Three failed password attempts later, I nearly spiked the damn thing against the wall. Then I remembered the -

Rain lashed against my apartment windows like angry fists, mirroring the storm brewing in my chest. My laptop screen displayed the mechanic's estimate—$1,800 for engine repairs. Public transportation here was a joke, and without my car, I'd lose gigs as a freelance photographer. Savings? Drained after last month's dental emergency. That metallic taste of panic flooded my mouth as I scanned loan options. Banks wanted tax returns and collateral; predatory sites flashed neon promises with 200% APR.

Rain lashed against my apartment windows like angry fists, mirroring the storm brewing in my chest. My laptop screen displayed the mechanic's estimate—$1,800 for engine repairs. Public transportation here was a joke, and without my car, I'd lose gigs as a freelance photographer. Savings? Drained after last month's dental emergency. That metallic taste of panic flooded my mouth as I scanned loan options. Banks wanted tax returns and collateral; predatory sites flashed neon promises with 200% APR. -

That Tuesday morning still burns in my memory - rain smearing my kitchen window while I frantically stabbed at my phone with greasy fingers. I'd just spilled coffee across three overdue bills when the notification chimed: "FINAL REMINDER: TAX PAYMENT DUE IN 2 HOURS." Panic seized my throat as I juggled banking apps like a circus clown on a unicycle. SBI for the tax, HDFC for EMIs, Paytm for utilities - each demanding different passwords, each flashing angry red warnings. My thumbprint failed twi

That Tuesday morning still burns in my memory - rain smearing my kitchen window while I frantically stabbed at my phone with greasy fingers. I'd just spilled coffee across three overdue bills when the notification chimed: "FINAL REMINDER: TAX PAYMENT DUE IN 2 HOURS." Panic seized my throat as I juggled banking apps like a circus clown on a unicycle. SBI for the tax, HDFC for EMIs, Paytm for utilities - each demanding different passwords, each flashing angry red warnings. My thumbprint failed twi -

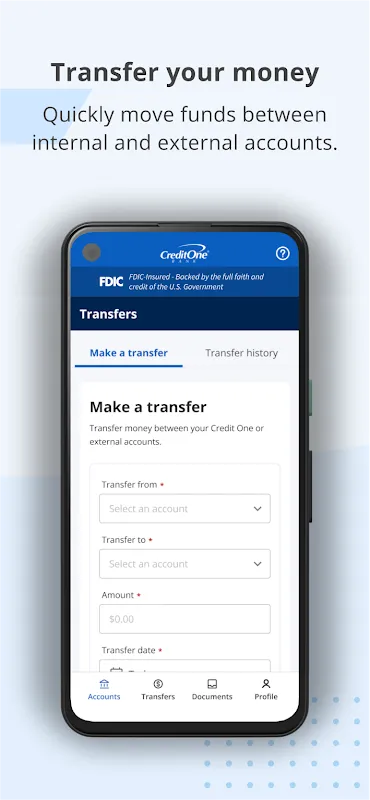

Rain lashed against the cabin windows like angry fists as I stared at the flickering satellite phone. Three days into the Alaskan fishing trip when the hospital called – Dad's emergency surgery required a deposit larger than my annual salary. Traditional banking? The nearest branch was 200 miles of washed-out roads away. My fingers trembled as I opened Credit One's mobile platform, each raindrop on the tin roof echoing the countdown clock in my head. That familiar blue interface loaded instantly

Rain lashed against the cabin windows like angry fists as I stared at the flickering satellite phone. Three days into the Alaskan fishing trip when the hospital called – Dad's emergency surgery required a deposit larger than my annual salary. Traditional banking? The nearest branch was 200 miles of washed-out roads away. My fingers trembled as I opened Credit One's mobile platform, each raindrop on the tin roof echoing the countdown clock in my head. That familiar blue interface loaded instantly -

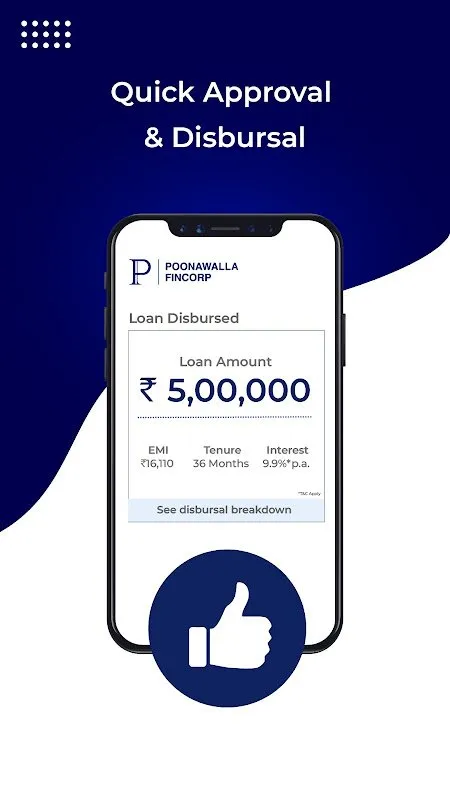

Sweat beaded on my forehead as I stared at the broken machinery in my garage workshop. The industrial lathe—my livelihood's heartbeat—had seized mid-operation with a final metallic shriek. My mechanic's grim diagnosis: "Complete bearing failure, needs full replacement by tomorrow or you're down for weeks." The quote made my stomach drop: $8,500. Cash reserves? Drained from last month's supplier payment delays. Banks? Closed for the weekend. That familiar vise of entrepreneurial dread tightened a

Sweat beaded on my forehead as I stared at the broken machinery in my garage workshop. The industrial lathe—my livelihood's heartbeat—had seized mid-operation with a final metallic shriek. My mechanic's grim diagnosis: "Complete bearing failure, needs full replacement by tomorrow or you're down for weeks." The quote made my stomach drop: $8,500. Cash reserves? Drained from last month's supplier payment delays. Banks? Closed for the weekend. That familiar vise of entrepreneurial dread tightened a -

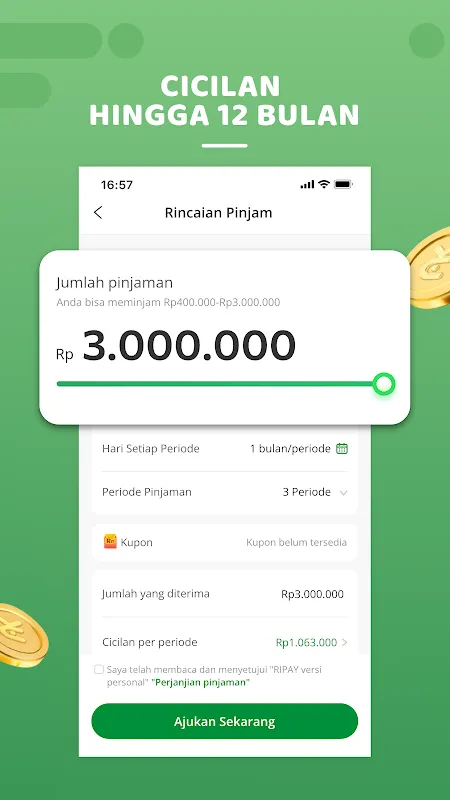

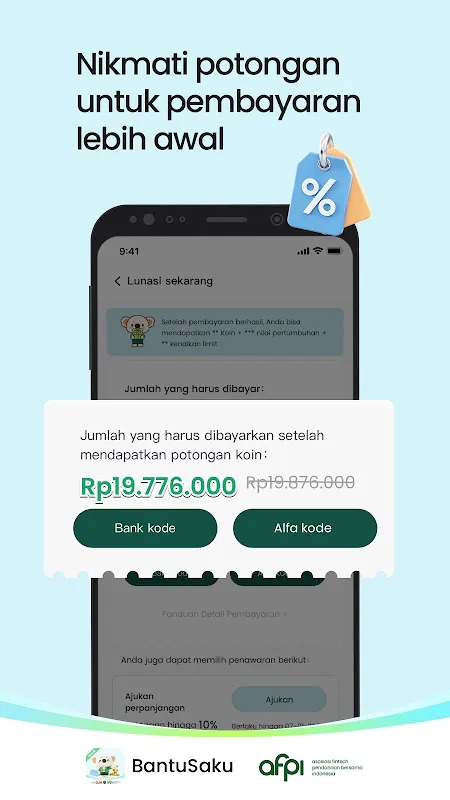

That Tuesday smelled like wet asphalt and desperation. My rattling Toyota gave its final cough halfway across the Jawa Barat toll road, surrendering to a seized engine as monsoon rains hammered the windshield. I remember counting coins in the cupholder – 37,000 rupiah – while mechanics quoted 8 million for repairs. My phone glowed with rejected bank notifications: "Insufficient collateral." Each buzz felt like a physical blow. When I frantically searched "urgent cash no assets," the play store s

That Tuesday smelled like wet asphalt and desperation. My rattling Toyota gave its final cough halfway across the Jawa Barat toll road, surrendering to a seized engine as monsoon rains hammered the windshield. I remember counting coins in the cupholder – 37,000 rupiah – while mechanics quoted 8 million for repairs. My phone glowed with rejected bank notifications: "Insufficient collateral." Each buzz felt like a physical blow. When I frantically searched "urgent cash no assets," the play store s -

QianJi - Finance, BudgetsQianji is an expense tracking application designed for users seeking a straightforward approach to personal bookkeeping. This app is available for the Android platform, making it accessible for a wide range of users looking to manage their finances effectively. With its focu

QianJi - Finance, BudgetsQianji is an expense tracking application designed for users seeking a straightforward approach to personal bookkeeping. This app is available for the Android platform, making it accessible for a wide range of users looking to manage their finances effectively. With its focu -

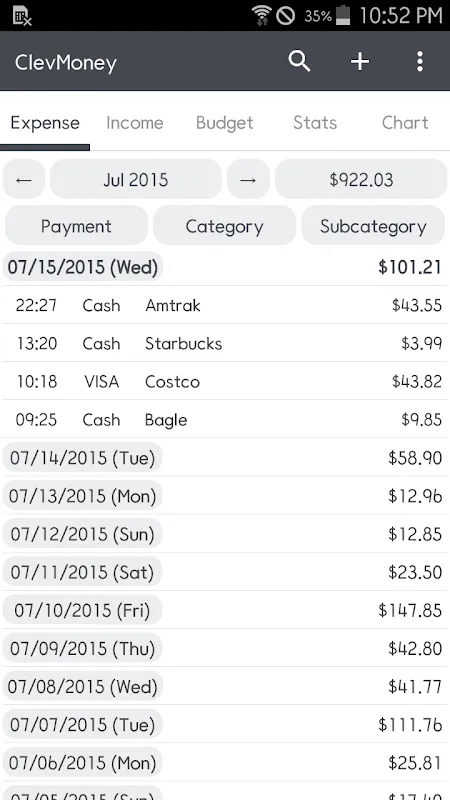

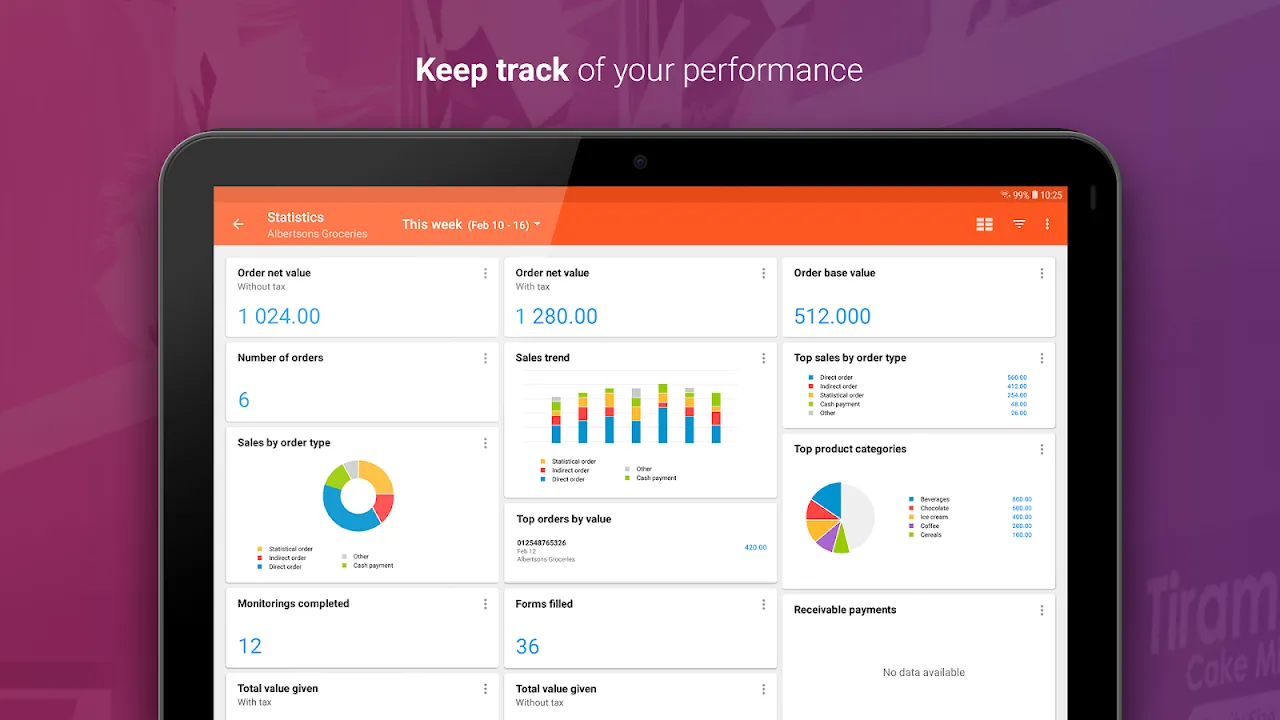

My ExpensesMy Expenses is a financial management application designed to assist users in tracking their expenses and income effectively. Available for the Android platform, this app offers users the opportunity to download a tool that simplifies the management of personal finances.The app enables effortless expense tracking, allowing individuals to monitor their spending and income seamlessly on their smartphones or tablets. Users can easily add transactions, categorize expenses, and view their

My ExpensesMy Expenses is a financial management application designed to assist users in tracking their expenses and income effectively. Available for the Android platform, this app offers users the opportunity to download a tool that simplifies the management of personal finances.The app enables effortless expense tracking, allowing individuals to monitor their spending and income seamlessly on their smartphones or tablets. Users can easily add transactions, categorize expenses, and view their -

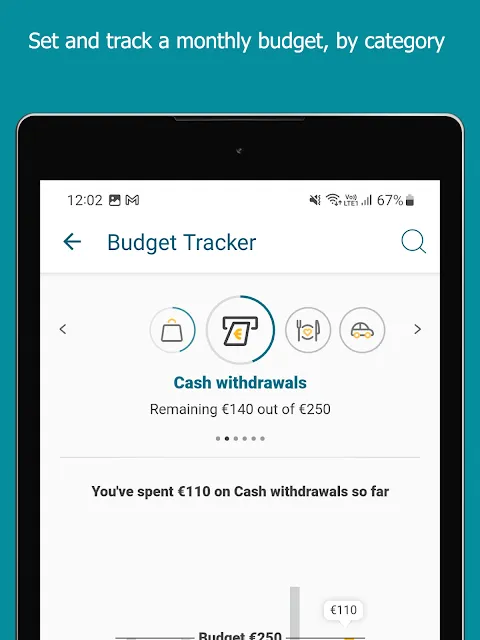

ICS BusinessKeep track of your business expenses wherever you are with the ICS Business App. You\xe2\x80\x99ll know what you have left to spend instantly. And online payments are a breeze with facial recognition or fingerprint.THE BENEFITS\xe2\x80\xa2\tCheck your expenses anytime and anywhere\xe2\x8

ICS BusinessKeep track of your business expenses wherever you are with the ICS Business App. You\xe2\x80\x99ll know what you have left to spend instantly. And online payments are a breeze with facial recognition or fingerprint.THE BENEFITS\xe2\x80\xa2\tCheck your expenses anytime and anywhere\xe2\x8 -

Rain lashed against my office window as I stared at the spreadsheet horror show. Three different versions of the Q3 portfolio report glared back - finance had one set of numbers, field ops another, and my desperate manual reconciliation attempt made a third. That sinking feeling hit when our Tokyo agent called about the "ghost listing" - a prime Shibuya property updated yesterday that vanished from headquarters' view. My fingers trembled over the keyboard as I fired off yet another sync command,

Rain lashed against my office window as I stared at the spreadsheet horror show. Three different versions of the Q3 portfolio report glared back - finance had one set of numbers, field ops another, and my desperate manual reconciliation attempt made a third. That sinking feeling hit when our Tokyo agent called about the "ghost listing" - a prime Shibuya property updated yesterday that vanished from headquarters' view. My fingers trembled over the keyboard as I fired off yet another sync command, -

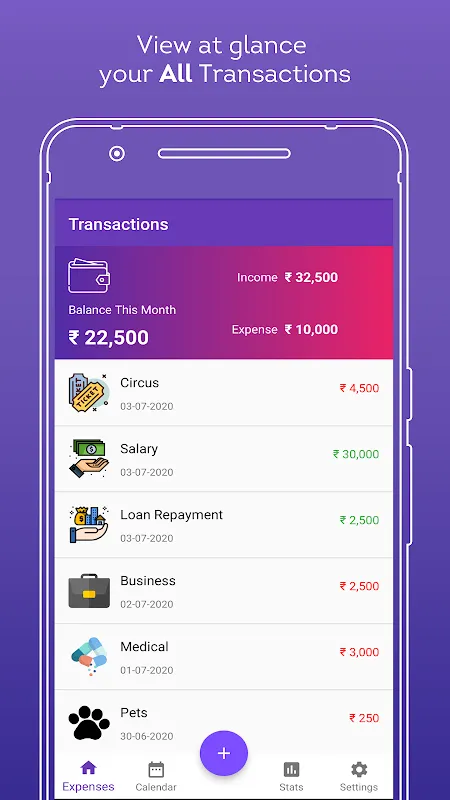

Spendee: Budget App & TrackerSave money effortlessly! Spendee is a FREE budget app and expense tracker loved by nearly 3,000,000 users worldwide. Track your expenses, optimize your budget, and gain full control over your finances.Seeing all your financial habits in one place helps you stay on track, reach your savings goals, and be more mindful of your spending. With Spendee, you have a powerful budget app and expense tracker that makes managing money simple and effective!\xf0\x9f\x92\xb0 All Yo

Spendee: Budget App & TrackerSave money effortlessly! Spendee is a FREE budget app and expense tracker loved by nearly 3,000,000 users worldwide. Track your expenses, optimize your budget, and gain full control over your finances.Seeing all your financial habits in one place helps you stay on track, reach your savings goals, and be more mindful of your spending. With Spendee, you have a powerful budget app and expense tracker that makes managing money simple and effective!\xf0\x9f\x92\xb0 All Yo