blockchain portfolio 2025-10-30T16:26:57Z

-

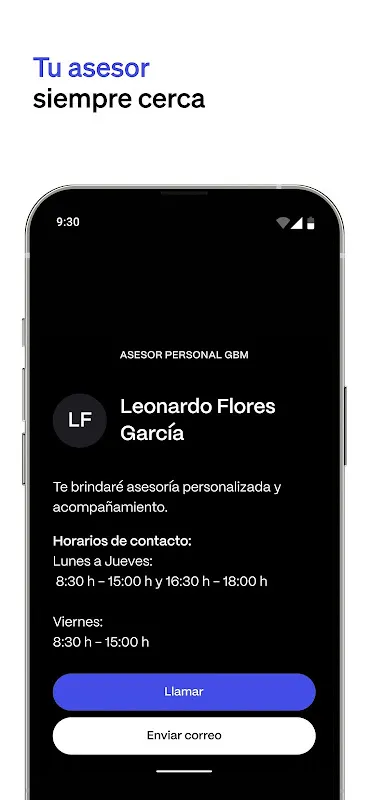

Rain lashed against my apartment windows that Tuesday night, mirroring the storm in my brokerage accounts. I’d just spent three hours juggling five different banking apps - a pixelated circus act where pesos vanished in conversion fees while dollar stocks blinked red across time zones. My thumb ached from switching tabs, and my coffee tasted like acid. That’s when I accidentally swiped into GBM’s ad between financial news sites. Skeptical but desperate, I downloaded it, not expecting salvation f

Rain lashed against my apartment windows that Tuesday night, mirroring the storm in my brokerage accounts. I’d just spent three hours juggling five different banking apps - a pixelated circus act where pesos vanished in conversion fees while dollar stocks blinked red across time zones. My thumb ached from switching tabs, and my coffee tasted like acid. That’s when I accidentally swiped into GBM’s ad between financial news sites. Skeptical but desperate, I downloaded it, not expecting salvation f -

VeWorldDive into the digital realm of vechain with VeWorld - the ultimate self-custody wallet designed for today's vefam trailblazers!\xf0\x9f\x94\x90 Absolute Control, Absolute Security* Self-Custody Mastery: Break free from third-party boundaries. With VeWorld, you hold the keys to your kingdom.*

VeWorldDive into the digital realm of vechain with VeWorld - the ultimate self-custody wallet designed for today's vefam trailblazers!\xf0\x9f\x94\x90 Absolute Control, Absolute Security* Self-Custody Mastery: Break free from third-party boundaries. With VeWorld, you hold the keys to your kingdom.* -

Rain lashed against my studio apartment window as I stared at yet another rejected loan application. That familiar pit in my stomach returned - the one reminding me I'd never own real estate in this lifetime. Then my thumb stumbled upon an app store listing promising virtual deeds. Skepticism warred with desperation until I tapped download. Within minutes, I stood at a digital crossroads in pixel-perfect Chicago, holding my first property token. The rush was immediate: that blue Victorian cottag

Rain lashed against my studio apartment window as I stared at yet another rejected loan application. That familiar pit in my stomach returned - the one reminding me I'd never own real estate in this lifetime. Then my thumb stumbled upon an app store listing promising virtual deeds. Skepticism warred with desperation until I tapped download. Within minutes, I stood at a digital crossroads in pixel-perfect Chicago, holding my first property token. The rush was immediate: that blue Victorian cottag -

Rainbow Ethereum WalletRainbow is a fun, simple, and secure way to get started with crypto and explore Ethereum. You can use Rainbow to purchase, manage, and display Ethereum-based assets on mainnet, Optimism, Arbitrum, Polygon, Base, and Zora.Great for newcomers and power users alike, Rainbow allow

Rainbow Ethereum WalletRainbow is a fun, simple, and secure way to get started with crypto and explore Ethereum. You can use Rainbow to purchase, manage, and display Ethereum-based assets on mainnet, Optimism, Arbitrum, Polygon, Base, and Zora.Great for newcomers and power users alike, Rainbow allow -

Rain lashed against my office window as the market crash notifications flooded my phone – a digital tsunami erasing months of gains in crimson percentages. My thumb trembled over the "SELL ALL" button, that primal urge to flee sharp as broken glass in my throat. That's when Scripbox's algorithm intervened like a zen master, flashing its risk-tolerance assessment from my last emotional calibration. Suddenly, complex Monte Carlo simulations materialized as a simple pulsating gauge: "Your portfolio

Rain lashed against my office window as the market crash notifications flooded my phone – a digital tsunami erasing months of gains in crimson percentages. My thumb trembled over the "SELL ALL" button, that primal urge to flee sharp as broken glass in my throat. That's when Scripbox's algorithm intervened like a zen master, flashing its risk-tolerance assessment from my last emotional calibration. Suddenly, complex Monte Carlo simulations materialized as a simple pulsating gauge: "Your portfolio -

Coinstore: Trade Crypto&FuturesCoinstore: Trade, Invest, and Hodl in cryptocurrency the safe and easy way. Buy and sell cryptocurrencies such as Bitcoin, Ethereum, DOGE, SHIB and many more. Coinstore cryptocurrency trading app simplifies trading and investment in cryptocurrency. Build your portfolio with crypto trading, and stay up to date with crypto live charts. Coinstore\xe2\x80\x99s easy to use UI helps you navigate and trade whether you are a crypto beginner or a seasoned trader.Our cryptoc

Coinstore: Trade Crypto&FuturesCoinstore: Trade, Invest, and Hodl in cryptocurrency the safe and easy way. Buy and sell cryptocurrencies such as Bitcoin, Ethereum, DOGE, SHIB and many more. Coinstore cryptocurrency trading app simplifies trading and investment in cryptocurrency. Build your portfolio with crypto trading, and stay up to date with crypto live charts. Coinstore\xe2\x80\x99s easy to use UI helps you navigate and trade whether you are a crypto beginner or a seasoned trader.Our cryptoc -

The auction clock glowed crimson - 47 seconds left. Sweat pooled under my VR headset as I frantically alt-tabbed between MetaMask and Phantom. That CryptoPunk wasn't just digital art; it was my grail, the one that completed my 2017 genesis collection. Yet here I was, watching Ethereum's gas fees spike to $347 while my Trezor flashed "transaction stalled" for the third time. My finger hovered over the "cancel bid" button when Chrome's new tab page taunted me with that blue hexagon icon I'd ignore

The auction clock glowed crimson - 47 seconds left. Sweat pooled under my VR headset as I frantically alt-tabbed between MetaMask and Phantom. That CryptoPunk wasn't just digital art; it was my grail, the one that completed my 2017 genesis collection. Yet here I was, watching Ethereum's gas fees spike to $347 while my Trezor flashed "transaction stalled" for the third time. My finger hovered over the "cancel bid" button when Chrome's new tab page taunted me with that blue hexagon icon I'd ignore -

Rain lashed against the window as my trembling fingers fumbled with yet another crypto exchange. I'd just witnessed XLM's value plummet 15% in twenty minutes - my life savings evaporating while some garbage platform demanded I authenticate through three different menus. Sweat pooled on my phone screen as error messages mocked me. In that moment of pure panic, I remembered the blue icon buried in my downloads: the one my blockchain professor had casually mentioned as "the only sane wallet for Ste

Rain lashed against the window as my trembling fingers fumbled with yet another crypto exchange. I'd just witnessed XLM's value plummet 15% in twenty minutes - my life savings evaporating while some garbage platform demanded I authenticate through three different menus. Sweat pooled on my phone screen as error messages mocked me. In that moment of pure panic, I remembered the blue icon buried in my downloads: the one my blockchain professor had casually mentioned as "the only sane wallet for Ste -

Teji Mandi: Investing & TradingTeji Mandi, a powered by Motilal Oswal, brings professionally curated stock portfolios to every kind of investor. With Rs 1,800+ crore assets under advisory (AUA) and the trust of 2,50,000+ subscribers, Teji Mandi makes stock investing and trading simple, transparent, and cost-effective.Why Choose Teji Mandi?SEBI-Registered Research Analysts: Trustworthy, regulated financial professional.Affordable Pricing: Plans start as low as \xe2\x82\xb999/month* with zero hi

Teji Mandi: Investing & TradingTeji Mandi, a powered by Motilal Oswal, brings professionally curated stock portfolios to every kind of investor. With Rs 1,800+ crore assets under advisory (AUA) and the trust of 2,50,000+ subscribers, Teji Mandi makes stock investing and trading simple, transparent, and cost-effective.Why Choose Teji Mandi?SEBI-Registered Research Analysts: Trustworthy, regulated financial professional.Affordable Pricing: Plans start as low as \xe2\x82\xb999/month* with zero hi -

Rain lashed against the window as my finger hovered over the uninstall button. Three years of spreadsheets, blinking red alerts, and sleepless nights had compressed into this single moment - the final admission that retail trading was just digital gambling with fancier charts. That's when the notification lit up my darkened bedroom: "Asset Manager DARWIN17 exceeded volatility target with 14% quarterly gain." The cold blue glow reflected in my exhausted eyes as I tapped, not knowing this stranger

Rain lashed against the window as my finger hovered over the uninstall button. Three years of spreadsheets, blinking red alerts, and sleepless nights had compressed into this single moment - the final admission that retail trading was just digital gambling with fancier charts. That's when the notification lit up my darkened bedroom: "Asset Manager DARWIN17 exceeded volatility target with 14% quarterly gain." The cold blue glow reflected in my exhausted eyes as I tapped, not knowing this stranger -

That Tuesday started with my hands shaking around a lukewarm mug as Hang Seng futures plummeted. I'd just poured life savings into a Chinese EV manufacturer, and now headlines screamed about subsidy cuts. My brokerage app showed terrifying red numbers while my spreadsheet - filled with outdated export figures and stale institutional reports - felt like reading hieroglyphs during an earthquake. In that panic, I remembered my finance professor's drunken rant about "institutional footprints," fumbl

That Tuesday started with my hands shaking around a lukewarm mug as Hang Seng futures plummeted. I'd just poured life savings into a Chinese EV manufacturer, and now headlines screamed about subsidy cuts. My brokerage app showed terrifying red numbers while my spreadsheet - filled with outdated export figures and stale institutional reports - felt like reading hieroglyphs during an earthquake. In that panic, I remembered my finance professor's drunken rant about "institutional footprints," fumbl -

Rain lashed against the cabin windows like angry fists, mirroring the storm brewing in my chest. I'd promised my family a tech-free week in Montana's backcountry - no Bloomberg terminals, no triple monitors, just raw wilderness and disconnected peace. That vow shattered at 3:17 AM when my phone buzzed like a dying wasp. Asian markets were collapsing, dragging my tech-heavy investments into freefall. Sweat pooled on my neck despite the mountain chill. My entire financial strategy was imploding wh

Rain lashed against the cabin windows like angry fists, mirroring the storm brewing in my chest. I'd promised my family a tech-free week in Montana's backcountry - no Bloomberg terminals, no triple monitors, just raw wilderness and disconnected peace. That vow shattered at 3:17 AM when my phone buzzed like a dying wasp. Asian markets were collapsing, dragging my tech-heavy investments into freefall. Sweat pooled on my neck despite the mountain chill. My entire financial strategy was imploding wh -

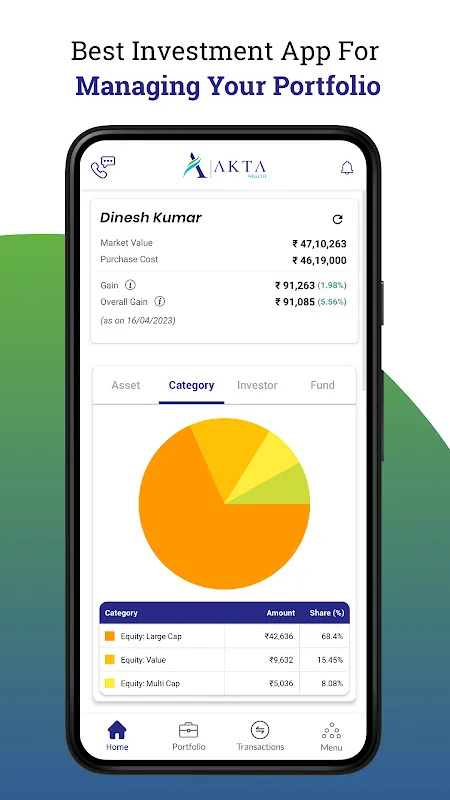

Rain streaked down my office window like liquid anxiety that Tuesday morning. My fingers trembled as I swiped between four different brokerage apps - each holding fragments of my financial soul hostage. Zerodha showed equities bleeding red, Groww displayed mutual funds flatlining, while some forgotten ETF platform kept sending panicked notifications I couldn't even locate anymore. My portfolio wasn't just fragmented; it was having a full-scale existential crisis across multiple dimensions.

Rain streaked down my office window like liquid anxiety that Tuesday morning. My fingers trembled as I swiped between four different brokerage apps - each holding fragments of my financial soul hostage. Zerodha showed equities bleeding red, Groww displayed mutual funds flatlining, while some forgotten ETF platform kept sending panicked notifications I couldn't even locate anymore. My portfolio wasn't just fragmented; it was having a full-scale existential crisis across multiple dimensions. -

Cold sweat glued my shirt to the chair as red numbers pulsed across three different brokerage apps. Earnings season had become a horror show overnight - my tech stocks were freefalling while I scrambled between tabs like a medic on a battlefield. My thumb hovered over the sell-all button when Zee Business' push notification sliced through the panic: Semiconductor Short Squeeze Imminent. That crimson alert was my lifeline.

Cold sweat glued my shirt to the chair as red numbers pulsed across three different brokerage apps. Earnings season had become a horror show overnight - my tech stocks were freefalling while I scrambled between tabs like a medic on a battlefield. My thumb hovered over the sell-all button when Zee Business' push notification sliced through the panic: Semiconductor Short Squeeze Imminent. That crimson alert was my lifeline. -

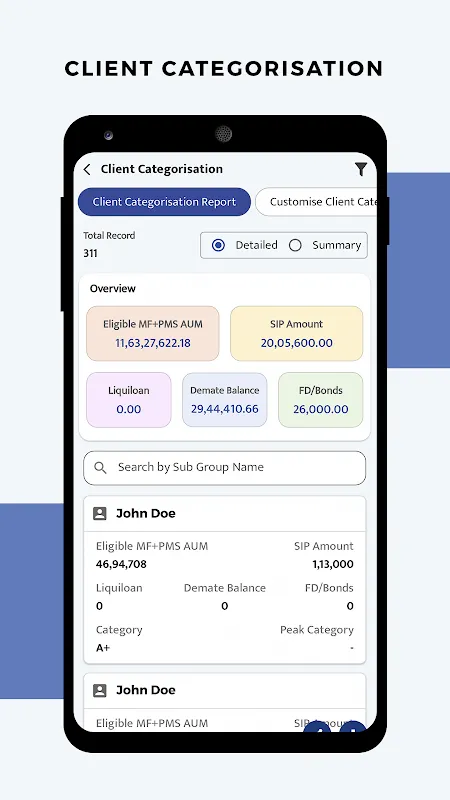

That Tuesday morning started with espresso bitterness lingering on my tongue as my phone buzzed violently against the mahogany desk. Jeremy's name flashed - my most anxious startup founder client - and I knew before answering. "The tech bloodbath! My portfolio's hemorrhaging!" he shouted, voice cracking like overstretched violin strings. My stomach dropped remembering last year's spreadsheet fiasco when market swings meant hours of manual recalculations while clients hyperventilated. But this ti

That Tuesday morning started with espresso bitterness lingering on my tongue as my phone buzzed violently against the mahogany desk. Jeremy's name flashed - my most anxious startup founder client - and I knew before answering. "The tech bloodbath! My portfolio's hemorrhaging!" he shouted, voice cracking like overstretched violin strings. My stomach dropped remembering last year's spreadsheet fiasco when market swings meant hours of manual recalculations while clients hyperventilated. But this ti -

Rain lashed against my home office window as I hunched over quarterly reports, that familiar acidic taste of adrenaline flooding my mouth. My smartwatch buzzed angrily – 165 bpm while sitting still. Again. Three months post-burnout and my body still treated spreadsheets like bear attacks. That's when VEDALEX's emergency protocol kicked in, flooding my screen not with panic-inducing charts, but with a breathing sphere expanding and contracting in sync with ancient Tibetan rhythms. I didn't even r

Rain lashed against my home office window as I hunched over quarterly reports, that familiar acidic taste of adrenaline flooding my mouth. My smartwatch buzzed angrily – 165 bpm while sitting still. Again. Three months post-burnout and my body still treated spreadsheets like bear attacks. That's when VEDALEX's emergency protocol kicked in, flooding my screen not with panic-inducing charts, but with a breathing sphere expanding and contracting in sync with ancient Tibetan rhythms. I didn't even r -

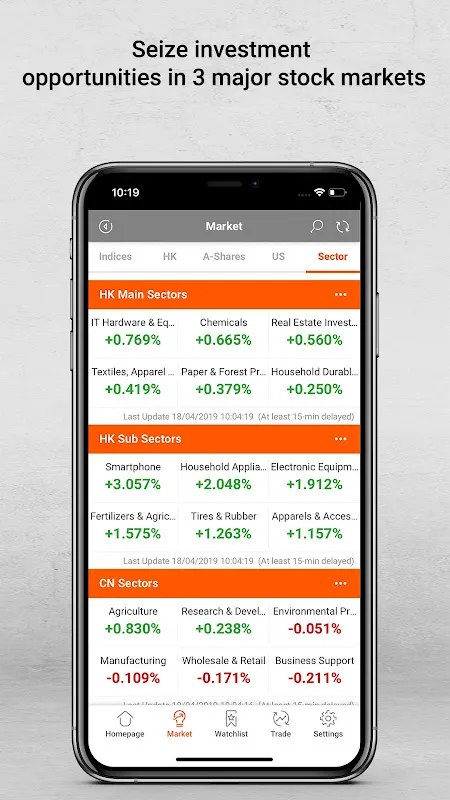

Rain lashed against my Tokyo apartment windows when the Nikkei futures started hemorrhaging. My throat tightened as three trading terminals flashed crimson - Hong Kong short positions unraveling, US tech options bleeding, Shanghai A-shares collapsing like dominoes. I fumbled for my phone, fingers trembling against cold glass, desperately swiping between broker apps while Bloomberg radio screamed about contagion risks. That's when the notification chimed: "Margin call trigger in 18min." My stomac

Rain lashed against my Tokyo apartment windows when the Nikkei futures started hemorrhaging. My throat tightened as three trading terminals flashed crimson - Hong Kong short positions unraveling, US tech options bleeding, Shanghai A-shares collapsing like dominoes. I fumbled for my phone, fingers trembling against cold glass, desperately swiping between broker apps while Bloomberg radio screamed about contagion risks. That's when the notification chimed: "Margin call trigger in 18min." My stomac -

Tuesday 3 AM sweat soaked my collar before markets even opened. That familiar dread: had the U.S. futures cratered? Did I leave that Singapore REIT position unhedged? My laptop glowed like a distress beacon in the dark, browser tabs vomiting spreadsheets—Bloomberg, local brokerage, currency converters—a digital hydra where slashing one head spawned three errors. Fingers cramped scrolling through disconnected numbers while my gut churned with imagined losses. Financial vertigo. That was before AK

Tuesday 3 AM sweat soaked my collar before markets even opened. That familiar dread: had the U.S. futures cratered? Did I leave that Singapore REIT position unhedged? My laptop glowed like a distress beacon in the dark, browser tabs vomiting spreadsheets—Bloomberg, local brokerage, currency converters—a digital hydra where slashing one head spawned three errors. Fingers cramped scrolling through disconnected numbers while my gut churned with imagined losses. Financial vertigo. That was before AK -

Rain lashed against my Bangkok high-rise window as I frantically toggled between six banking apps, my espresso turning cold beside the glowing triptych of monitors. Singapore REITs here, Frankfurt bonds there, Mumbai equities elsewhere - each platform demanded different logins, displayed conflicting performance metrics, and laughed at my attempts to see the whole picture. My finger cramped from switching tabs when the notification appeared: "Your global exposure exceeds risk parameters by 17%."

Rain lashed against my Bangkok high-rise window as I frantically toggled between six banking apps, my espresso turning cold beside the glowing triptych of monitors. Singapore REITs here, Frankfurt bonds there, Mumbai equities elsewhere - each platform demanded different logins, displayed conflicting performance metrics, and laughed at my attempts to see the whole picture. My finger cramped from switching tabs when the notification appeared: "Your global exposure exceeds risk parameters by 17%." -

Sweat prickled my neck as Bloomberg terminals flashed blood-red across the trading floor. It was 3:17 AM Tokyo time when the European bond rout triggered dominoes across my holdings - Japanese REITs collapsing, Singapore ETFs hemorrhaging, gold futures swinging wildly. My trembling fingers fumbled across three brokerage apps like a drunk pianist, each platform showing fragmented nightmares. That's when I slammed my fist on the hotel minibar, sending Asahi cans clattering as I remembered the mult

Sweat prickled my neck as Bloomberg terminals flashed blood-red across the trading floor. It was 3:17 AM Tokyo time when the European bond rout triggered dominoes across my holdings - Japanese REITs collapsing, Singapore ETFs hemorrhaging, gold futures swinging wildly. My trembling fingers fumbled across three brokerage apps like a drunk pianist, each platform showing fragmented nightmares. That's when I slammed my fist on the hotel minibar, sending Asahi cans clattering as I remembered the mult