financial inclusion 2025-10-27T06:11:02Z

-

It happened during what was supposed to be a routine client meeting in downtown Chicago. Rain lashed against the conference room windows while I presented quarterly projections, trying to ignore the persistent vibration in my pocket. During a coffee break, I checked my phone to find seventeen missed calls from our manufacturing partner in Germany. Their raw materials shipment was held at customs pending immediate wire confirmation - a $287,000 transaction that would halt our production line with

It happened during what was supposed to be a routine client meeting in downtown Chicago. Rain lashed against the conference room windows while I presented quarterly projections, trying to ignore the persistent vibration in my pocket. During a coffee break, I checked my phone to find seventeen missed calls from our manufacturing partner in Germany. Their raw materials shipment was held at customs pending immediate wire confirmation - a $287,000 transaction that would halt our production line with -

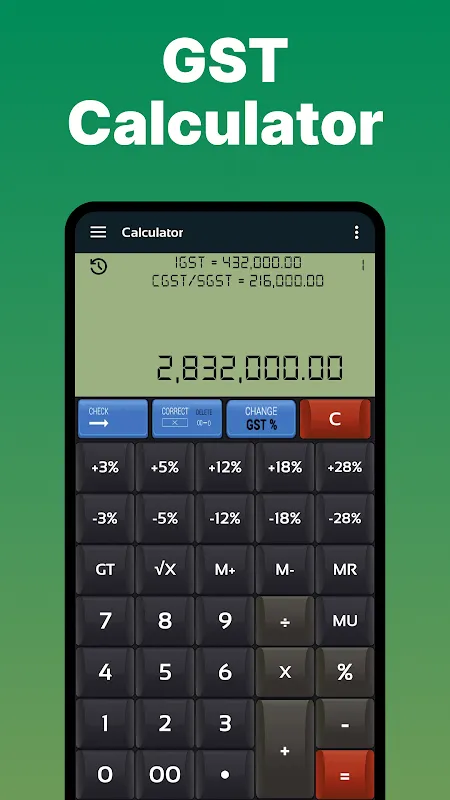

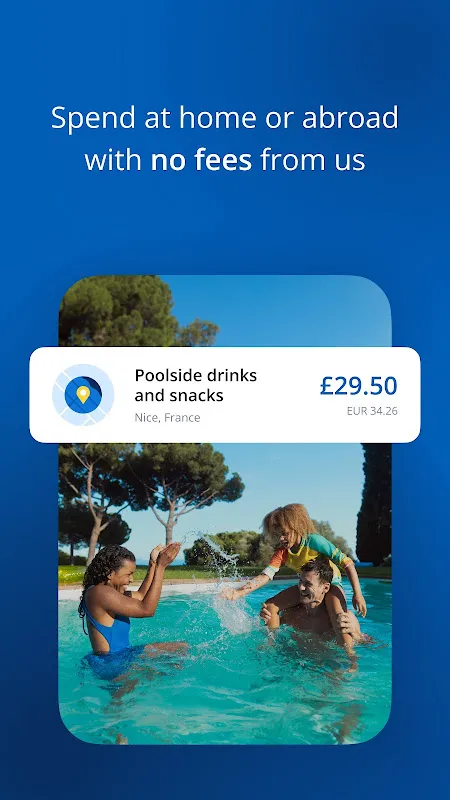

I remember the sinking feeling in my stomach as I stood in that bustling Barcelona market, colorful stalls stretching endlessly, vendors shouting prices in rapid Spanish that blurred into noise. My hands were clammy, clutching euros that felt foreign and insufficient. I was trying to buy souvenirs for family back home, but the mental math of converting prices to USD was making my head spin. Every calculation felt like guesswork, and I could feel the anxiety mounting—would I overspend? Be ripped

I remember the sinking feeling in my stomach as I stood in that bustling Barcelona market, colorful stalls stretching endlessly, vendors shouting prices in rapid Spanish that blurred into noise. My hands were clammy, clutching euros that felt foreign and insufficient. I was trying to buy souvenirs for family back home, but the mental math of converting prices to USD was making my head spin. Every calculation felt like guesswork, and I could feel the anxiety mounting—would I overspend? Be ripped -

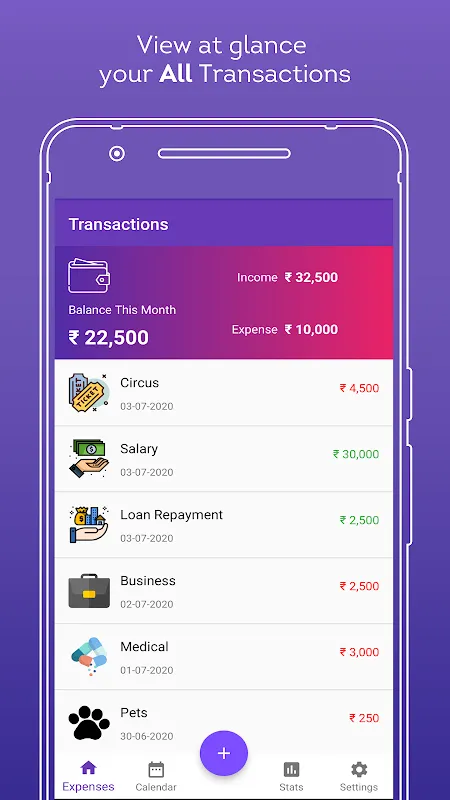

It all started when my freelance graphic design work dried up last month. Bills were piling up, and anxiety was my constant companion. I remember scrolling through job apps, feeling hopeless, until a friend mentioned trying out food delivery. That's how I stumbled upon this platform—let's call it the wheels to my wallet. Signing up was a breeze; within hours, I was approved and ready to hit the road on my old bicycle, equipped with nothing but determination and a smartphone.

It all started when my freelance graphic design work dried up last month. Bills were piling up, and anxiety was my constant companion. I remember scrolling through job apps, feeling hopeless, until a friend mentioned trying out food delivery. That's how I stumbled upon this platform—let's call it the wheels to my wallet. Signing up was a breeze; within hours, I was approved and ready to hit the road on my old bicycle, equipped with nothing but determination and a smartphone. -

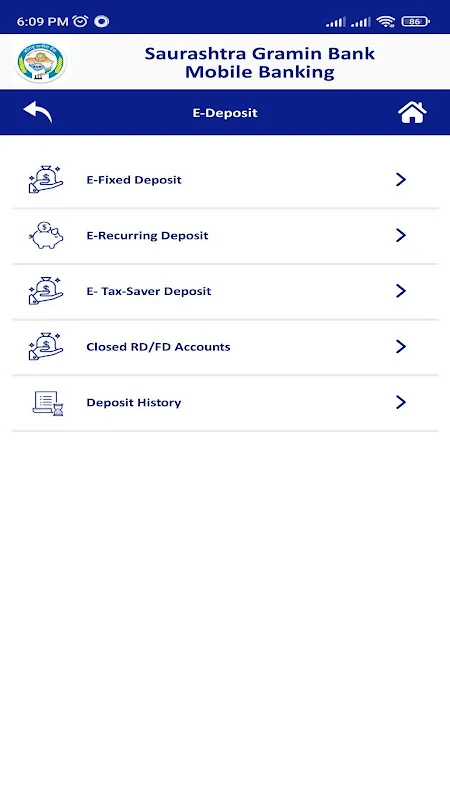

I was miles from civilization, camping in the Rockies with spotty cell service, when an email notification buzzed on my phone—my mortgage payment was due in hours, and I had completely forgotten. Panic surged through me; the nearest bank was a two-hour drive away, and I had no laptop. My heart raced as I fumbled with my phone, opening the GGB mBanking app, which I had downloaded weeks ago but never seriously used. The interface loaded slowly due to the weak signal, and for a moment, I feared it

I was miles from civilization, camping in the Rockies with spotty cell service, when an email notification buzzed on my phone—my mortgage payment was due in hours, and I had completely forgotten. Panic surged through me; the nearest bank was a two-hour drive away, and I had no laptop. My heart raced as I fumbled with my phone, opening the GGB mBanking app, which I had downloaded weeks ago but never seriously used. The interface loaded slowly due to the weak signal, and for a moment, I feared it -

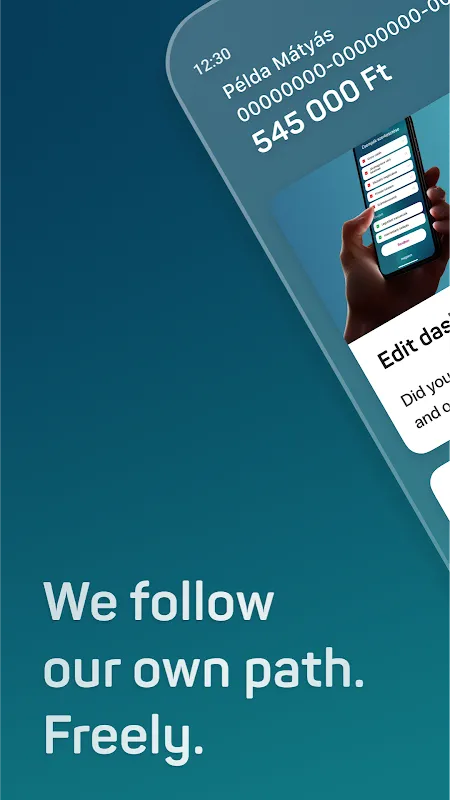

It all started on a rainy Tuesday evening in London. I was cozied up in my favorite armchair, sipping tea, when an email notification buzzed on my phone. It was from my landlord, reminding me that the rent was due—tomorrow. Panic jolted through me; I had completely forgotten amidst the chaos of work deadlines. My heart raced as I imagined the late fees and awkward explanations. But then, I remembered the MBH Bank App, tucked away on my home screen. This wasn't just any app; it had become my digi

It all started on a rainy Tuesday evening in London. I was cozied up in my favorite armchair, sipping tea, when an email notification buzzed on my phone. It was from my landlord, reminding me that the rent was due—tomorrow. Panic jolted through me; I had completely forgotten amidst the chaos of work deadlines. My heart raced as I imagined the late fees and awkward explanations. But then, I remembered the MBH Bank App, tucked away on my home screen. This wasn't just any app; it had become my digi -

I'll never forget the smell of burnt coffee and panic that hung in the air that Tuesday morning. My daughter's school trip payment was due in 90 minutes, and my bank's app had just greeted me with that spinning wheel of doom - the digital equivalent of a padlocked vault. Sweat trickled down my temple as I watched precious minutes evaporate, imagining her disappointed face when classmates boarded the bus without her. That's when Maria, our office intern, leaned over and whispered, "Try u-money -

I'll never forget the smell of burnt coffee and panic that hung in the air that Tuesday morning. My daughter's school trip payment was due in 90 minutes, and my bank's app had just greeted me with that spinning wheel of doom - the digital equivalent of a padlocked vault. Sweat trickled down my temple as I watched precious minutes evaporate, imagining her disappointed face when classmates boarded the bus without her. That's when Maria, our office intern, leaned over and whispered, "Try u-money - -

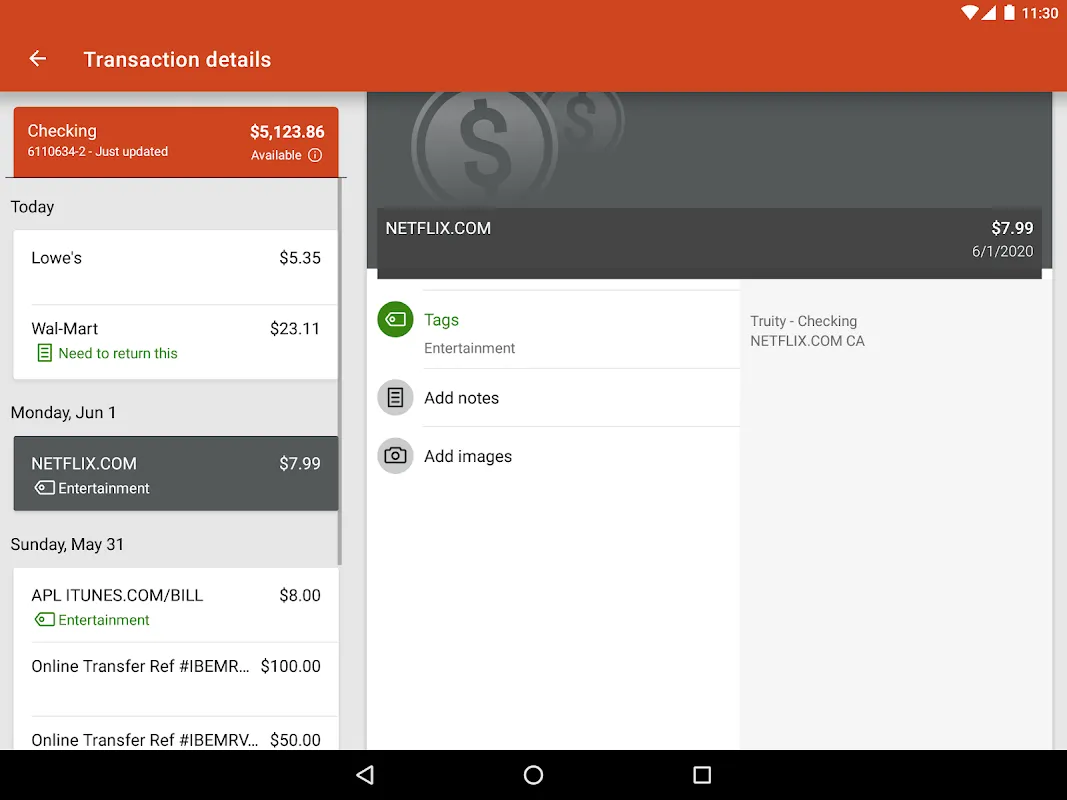

Rain lashed against the taxi window as Bangkok's neon lights blurred into watery streaks. My fingers trembled against the cracked phone screen - that sudden hotel charge notification had just drained my primary account. Frigid dread shot through me when I remembered my emergency funds were scattered across three banks back home. Pre-Truity days would've meant frantic calls to overseas helplines, password resets, and praying airport WiFi wouldn't timeout. But now? One shaky thumb-press launched w

Rain lashed against the taxi window as Bangkok's neon lights blurred into watery streaks. My fingers trembled against the cracked phone screen - that sudden hotel charge notification had just drained my primary account. Frigid dread shot through me when I remembered my emergency funds were scattered across three banks back home. Pre-Truity days would've meant frantic calls to overseas helplines, password resets, and praying airport WiFi wouldn't timeout. But now? One shaky thumb-press launched w -

Rain lashed against my rental car windshield as I white-knuckled the steering wheel along that cursed Swiss alpine pass. The engine sputtered violently before dying completely - leaving me stranded in a cloud bank with zero cell reception and dwindling daylight. Panic set in when I realized the tow truck driver only accepted instant bank transfers, waving away my credit cards with a dismissive grunt. My traditional bank app? Useless without signal, demanding layers of authentication that might a

Rain lashed against my rental car windshield as I white-knuckled the steering wheel along that cursed Swiss alpine pass. The engine sputtered violently before dying completely - leaving me stranded in a cloud bank with zero cell reception and dwindling daylight. Panic set in when I realized the tow truck driver only accepted instant bank transfers, waving away my credit cards with a dismissive grunt. My traditional bank app? Useless without signal, demanding layers of authentication that might a -

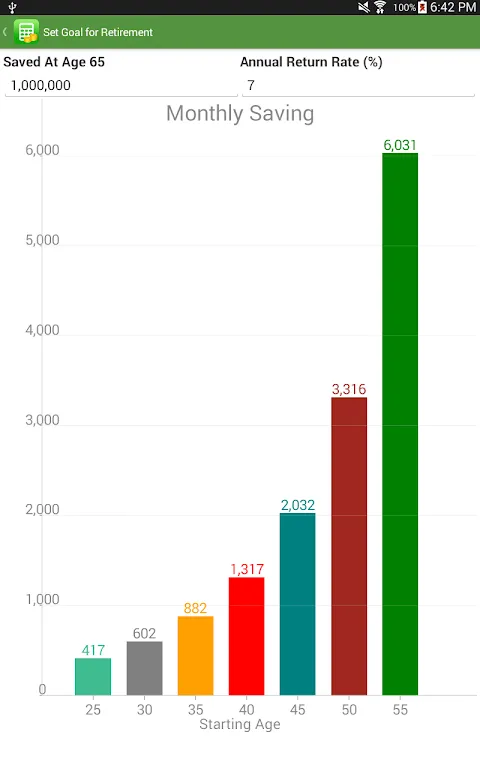

The smell of burnt toast snapped me back to reality as my trembling fingers hovered over the keyboard. There I was, 6:45 AM with oatmeal congealing in the bowl, staring at seven browser tabs of conflicting mortgage advice. My laptop screen glared back like an accusatory eye - how could I face Sarah at breakfast pretending we could afford that Craftsman bungalow? Every online calculator demanded email signups or leaked personal data like a sieve. That's when my thumb, moving on pure desperation,

The smell of burnt toast snapped me back to reality as my trembling fingers hovered over the keyboard. There I was, 6:45 AM with oatmeal congealing in the bowl, staring at seven browser tabs of conflicting mortgage advice. My laptop screen glared back like an accusatory eye - how could I face Sarah at breakfast pretending we could afford that Craftsman bungalow? Every online calculator demanded email signups or leaked personal data like a sieve. That's when my thumb, moving on pure desperation, -

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years -

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban -

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism.

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism. -

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone -

Thirty nautical miles offshore with nothing but indigo waves stretching to the horizon, I discovered the anchor chain had sawed through the bow roller during the night storm. Salt crusted my lips as I surveyed the damage - not just to the boat, but to my carefully planned circumnavigation budget. The Croatian marina manager's ultimatum crackled through the satellite phone: "Pay 80% deposit by noon or we give your berth to charter fleet." My stomach dropped like a lead weight. Banks? Closed for S

Thirty nautical miles offshore with nothing but indigo waves stretching to the horizon, I discovered the anchor chain had sawed through the bow roller during the night storm. Salt crusted my lips as I surveyed the damage - not just to the boat, but to my carefully planned circumnavigation budget. The Croatian marina manager's ultimatum crackled through the satellite phone: "Pay 80% deposit by noon or we give your berth to charter fleet." My stomach dropped like a lead weight. Banks? Closed for S -

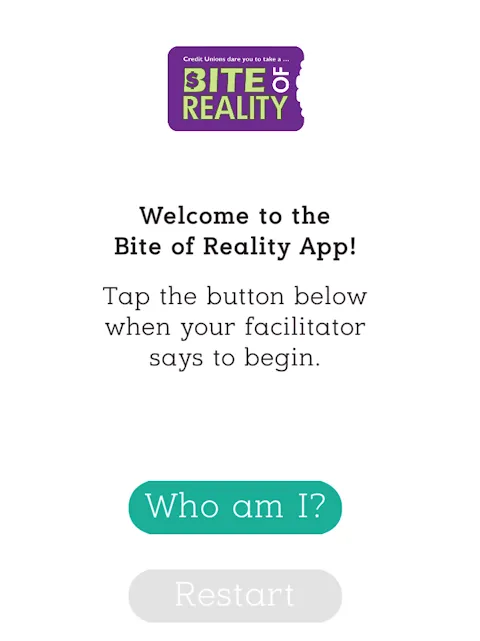

The microwave beeped at 2 AM, echoing through my empty apartment as I stared at another ramen dinner. My phone buzzed with a payment declined notification - third time this week. I could taste the salt of cheap noodles and desperation. That's when Sarah from the credit union slid a pamphlet across her desk. "Try this," she said, "it'll hurt less than actual bankruptcy." I scoffed, but that night, with eviction notices looming, I downloaded Bite of Reality 2. What followed wasn't just education;

The microwave beeped at 2 AM, echoing through my empty apartment as I stared at another ramen dinner. My phone buzzed with a payment declined notification - third time this week. I could taste the salt of cheap noodles and desperation. That's when Sarah from the credit union slid a pamphlet across her desk. "Try this," she said, "it'll hurt less than actual bankruptcy." I scoffed, but that night, with eviction notices looming, I downloaded Bite of Reality 2. What followed wasn't just education; -

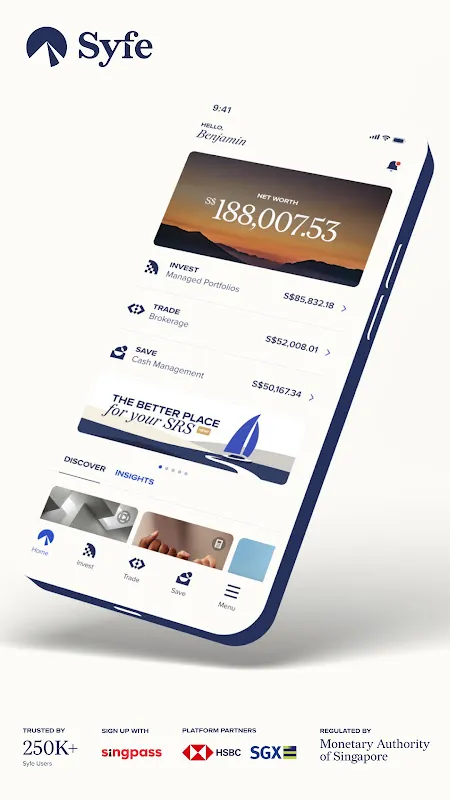

Rain lashed against the window as I stared at the spreadsheet mocking me from my screen. Another month, another paycheck devoured by bills while my savings stagnated. That gnawing realization hit like physical pain - my money was dying a slow death in that 0.05% interest account while inflation laughed at my financial illiteracy. I'd tried brokerage apps before, but staring at complex charts felt like deciphering alien hieroglyphs after 10-hour coding marathons. My attempt at stock picking ended

Rain lashed against the window as I stared at the spreadsheet mocking me from my screen. Another month, another paycheck devoured by bills while my savings stagnated. That gnawing realization hit like physical pain - my money was dying a slow death in that 0.05% interest account while inflation laughed at my financial illiteracy. I'd tried brokerage apps before, but staring at complex charts felt like deciphering alien hieroglyphs after 10-hour coding marathons. My attempt at stock picking ended -

The scent of burnt spices still clung to my clothes as I stood frozen in the dimly lit alley, fingers trembling against my phone screen. My wallet had just been lifted in the Jemaa el-Fnaa chaos, leaving me with nothing but a drained local SIM and 37% battery. Panic tasted like copper as I frantically swiped between banking apps - each demanding separate authentication, each mocking me with loading wheels. My savings account demanded fingerprint verification while the travel card app insisted on

The scent of burnt spices still clung to my clothes as I stood frozen in the dimly lit alley, fingers trembling against my phone screen. My wallet had just been lifted in the Jemaa el-Fnaa chaos, leaving me with nothing but a drained local SIM and 37% battery. Panic tasted like copper as I frantically swiped between banking apps - each demanding separate authentication, each mocking me with loading wheels. My savings account demanded fingerprint verification while the travel card app insisted on -

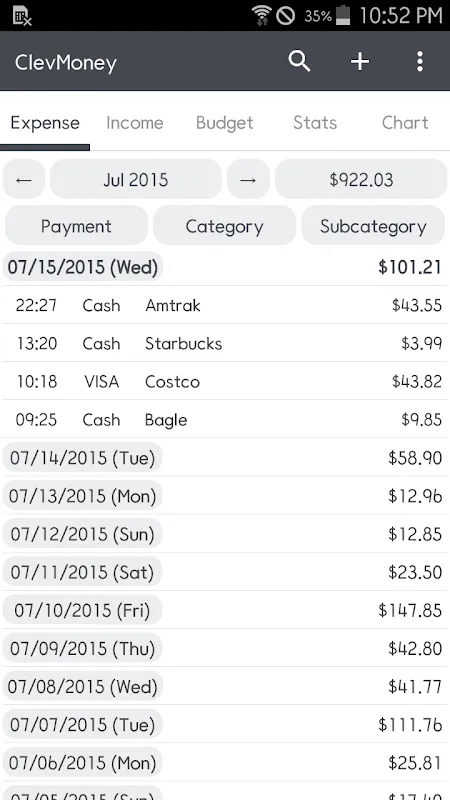

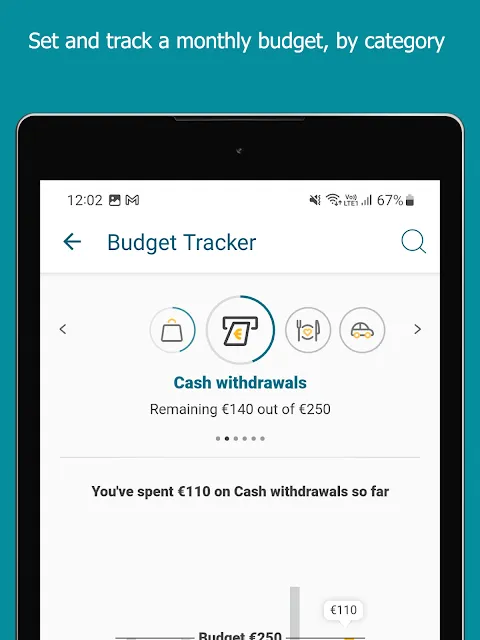

That piercing notification sound still haunts me - the overdraft alert vibrating through my phone at 3 AM. My throat tightened as I scrambled between four banking apps, fingers trembling against the cold screen. "Where did it go?" I whispered to the darkness, mentally retracing coffee runs and impulse purchases. The numbers blurred into meaningless digits until I accidentally opened this money command hub. Within seconds, crimson expense categories glared back: 47% on food delivery, 12% on forgo

That piercing notification sound still haunts me - the overdraft alert vibrating through my phone at 3 AM. My throat tightened as I scrambled between four banking apps, fingers trembling against the cold screen. "Where did it go?" I whispered to the darkness, mentally retracing coffee runs and impulse purchases. The numbers blurred into meaningless digits until I accidentally opened this money command hub. Within seconds, crimson expense categories glared back: 47% on food delivery, 12% on forgo -

Rain lashed against my bedroom window at 2:37 AM when the notification buzzed violently under my pillow. Stock futures were cratering 800 points. That acidic dread flooded my throat - the kind that tastes like copper pennies and regret. My IRA had already bled 11% this quarter. In the suffocating dark, I fumbled for my phone, cold sweat making the screen slip through my trembling fingers. Three failed password attempts later, I nearly spiked the damn thing against the wall. Then I remembered the

Rain lashed against my bedroom window at 2:37 AM when the notification buzzed violently under my pillow. Stock futures were cratering 800 points. That acidic dread flooded my throat - the kind that tastes like copper pennies and regret. My IRA had already bled 11% this quarter. In the suffocating dark, I fumbled for my phone, cold sweat making the screen slip through my trembling fingers. Three failed password attempts later, I nearly spiked the damn thing against the wall. Then I remembered the -

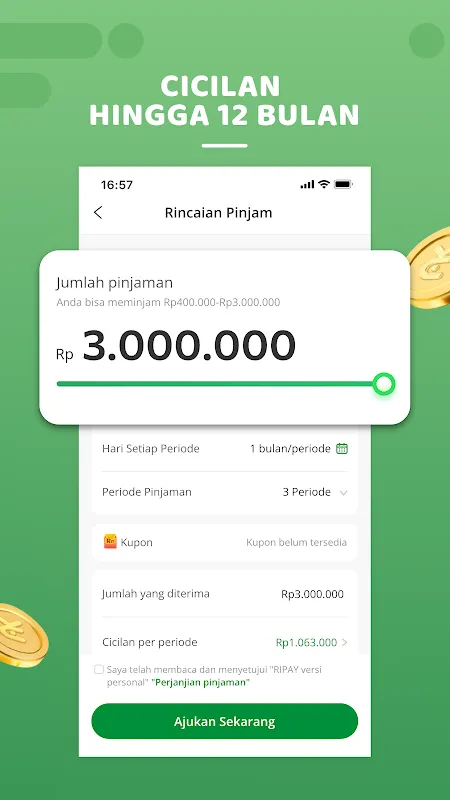

Rain lashed against my apartment windows like angry fists, mirroring the storm brewing in my chest. My laptop screen displayed the mechanic's estimate—$1,800 for engine repairs. Public transportation here was a joke, and without my car, I'd lose gigs as a freelance photographer. Savings? Drained after last month's dental emergency. That metallic taste of panic flooded my mouth as I scanned loan options. Banks wanted tax returns and collateral; predatory sites flashed neon promises with 200% APR.

Rain lashed against my apartment windows like angry fists, mirroring the storm brewing in my chest. My laptop screen displayed the mechanic's estimate—$1,800 for engine repairs. Public transportation here was a joke, and without my car, I'd lose gigs as a freelance photographer. Savings? Drained after last month's dental emergency. That metallic taste of panic flooded my mouth as I scanned loan options. Banks wanted tax returns and collateral; predatory sites flashed neon promises with 200% APR.