financial volatility 2025-11-20T23:19:37Z

-

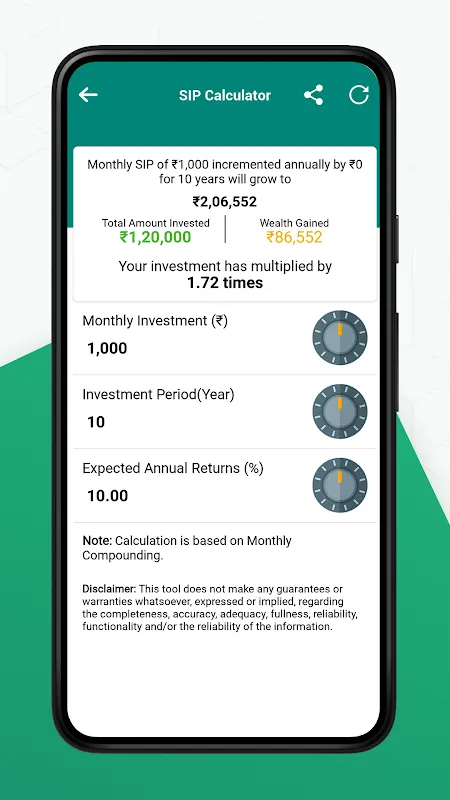

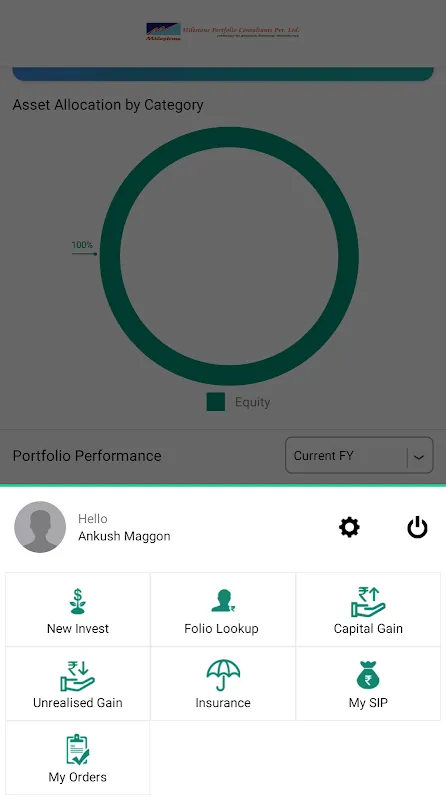

FinanzIndiaFinanzindia is an app designed for investors to monitor their investment portfolio.This app is only for the clients of Finanzindia It offers a daily overview of your investments, reflecting the latest market changes, and displays information on your SIP (Systematic Investment Plan) and ST

FinanzIndiaFinanzindia is an app designed for investors to monitor their investment portfolio.This app is only for the clients of Finanzindia It offers a daily overview of your investments, reflecting the latest market changes, and displays information on your SIP (Systematic Investment Plan) and ST -

CNBC: Business & Stock NewsWhen global news breaks, it sends ripples in markets all around the world. Get real-time coverage on the CNBC mobile app to stay in the know on the latest current events affecting the market. Around-the-clock market coverage ensures you are always informed \xe2\x80\x93 whenever and wherever the news breaks. The CNBC mobile app lets you access accurate and actionable business news, financial information, market data and primetime programming faster than ever. Breaking n

CNBC: Business & Stock NewsWhen global news breaks, it sends ripples in markets all around the world. Get real-time coverage on the CNBC mobile app to stay in the know on the latest current events affecting the market. Around-the-clock market coverage ensures you are always informed \xe2\x80\x93 whenever and wherever the news breaks. The CNBC mobile app lets you access accurate and actionable business news, financial information, market data and primetime programming faster than ever. Breaking n -

Elearnmarkets- Learn to InvestElearnmarkets is a stock market learning platform with over 3 million users, offering 30+ expert-led courses, 300+ live and recorded webinars, eBooks, book summaries, and financial calculators. The platform helps learners master stock trading, investment strategies, tec

Elearnmarkets- Learn to InvestElearnmarkets is a stock market learning platform with over 3 million users, offering 30+ expert-led courses, 300+ live and recorded webinars, eBooks, book summaries, and financial calculators. The platform helps learners master stock trading, investment strategies, tec -

Rain lashed against the café window as I stabbed at my phone screen, frustration tightening my throat. Another spreadsheet error – this time a miscalculated compound interest formula that vaporized $1,200 of imaginary returns. My hands smelled like stale coffee and desperation. That's when SMIFS Mutual Funds ambushed me through a finance podcast ad. Skeptical? Absolutely. But three days later, watching my fragmented Fidelity holdings, Vanguard IRAs, and even that forgotten Treasury bond material

Rain lashed against the café window as I stabbed at my phone screen, frustration tightening my throat. Another spreadsheet error – this time a miscalculated compound interest formula that vaporized $1,200 of imaginary returns. My hands smelled like stale coffee and desperation. That's when SMIFS Mutual Funds ambushed me through a finance podcast ad. Skeptical? Absolutely. But three days later, watching my fragmented Fidelity holdings, Vanguard IRAs, and even that forgotten Treasury bond material -

Rain lashed against the airport windows as flight cancellations blinked red on the departures board – and my phone buzzed with Bloomberg alerts about the Asian markets cratering. I was stranded in Oslo, jetlagged and disconnected, with 60% of my net worth suddenly evaporating in overseas equities. My fingers trembled on the phone. This was supposed to be a quick consultancy trip, not a financial heart attack. I’d left my spreadsheets and brokerage passwords back in New York. All I had was mNives

Rain lashed against the airport windows as flight cancellations blinked red on the departures board – and my phone buzzed with Bloomberg alerts about the Asian markets cratering. I was stranded in Oslo, jetlagged and disconnected, with 60% of my net worth suddenly evaporating in overseas equities. My fingers trembled on the phone. This was supposed to be a quick consultancy trip, not a financial heart attack. I’d left my spreadsheets and brokerage passwords back in New York. All I had was mNives -

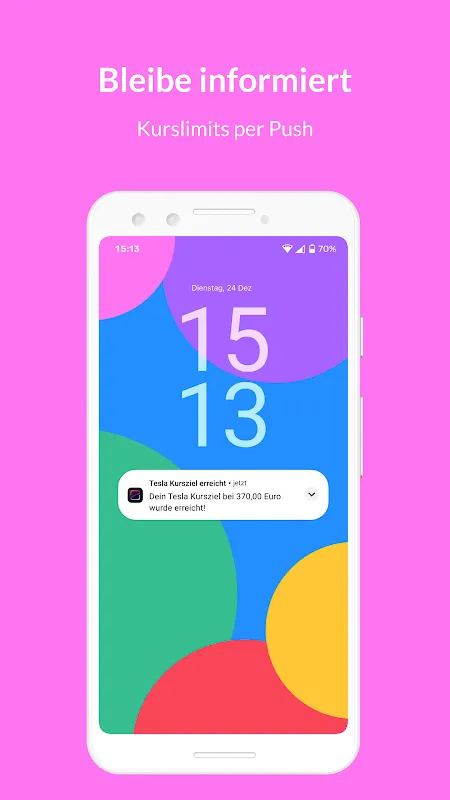

Rain lashed against my Berlin apartment window as I frantically refreshed three different trading platforms. Bitcoin had just nosedived 15% in twenty minutes, and my portfolio was bleeding crimson. Sweat pooled under my collar despite the October chill - this wasn't just volatility; it was financial freefall. Then I remembered the neon green icon I'd sidelined weeks ago: finanzen.net zero. What happened next rewired my understanding of panic trading forever.

Rain lashed against my Berlin apartment window as I frantically refreshed three different trading platforms. Bitcoin had just nosedived 15% in twenty minutes, and my portfolio was bleeding crimson. Sweat pooled under my collar despite the October chill - this wasn't just volatility; it was financial freefall. Then I remembered the neon green icon I'd sidelined weeks ago: finanzen.net zero. What happened next rewired my understanding of panic trading forever. -

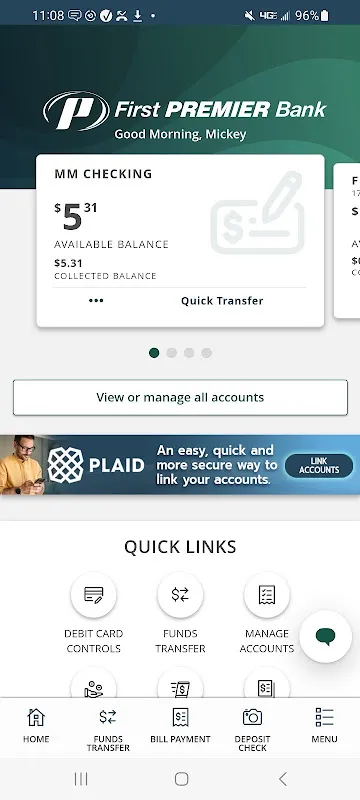

It was in the cramped backseat of a taxi speeding through Rome's chaotic streets that I realized I had made a catastrophic error. My wallet - containing all my credit cards and cash - lay forgotten on a café table miles away, and I was racing to catch a flight home. Sweat beaded on my forehead as the meter ticked upward, each euro symbol feeling like a judgment. In that moment of pure panic, my trembling fingers found my phone and the icon for digital banking solution I'd installed but never pro

It was in the cramped backseat of a taxi speeding through Rome's chaotic streets that I realized I had made a catastrophic error. My wallet - containing all my credit cards and cash - lay forgotten on a café table miles away, and I was racing to catch a flight home. Sweat beaded on my forehead as the meter ticked upward, each euro symbol feeling like a judgment. In that moment of pure panic, my trembling fingers found my phone and the icon for digital banking solution I'd installed but never pro -

It happened during what was supposed to be a routine client meeting in downtown Chicago. Rain lashed against the conference room windows while I presented quarterly projections, trying to ignore the persistent vibration in my pocket. During a coffee break, I checked my phone to find seventeen missed calls from our manufacturing partner in Germany. Their raw materials shipment was held at customs pending immediate wire confirmation - a $287,000 transaction that would halt our production line with

It happened during what was supposed to be a routine client meeting in downtown Chicago. Rain lashed against the conference room windows while I presented quarterly projections, trying to ignore the persistent vibration in my pocket. During a coffee break, I checked my phone to find seventeen missed calls from our manufacturing partner in Germany. Their raw materials shipment was held at customs pending immediate wire confirmation - a $287,000 transaction that would halt our production line with -

I remember the sinking feeling in my stomach as I stood in that bustling Barcelona market, colorful stalls stretching endlessly, vendors shouting prices in rapid Spanish that blurred into noise. My hands were clammy, clutching euros that felt foreign and insufficient. I was trying to buy souvenirs for family back home, but the mental math of converting prices to USD was making my head spin. Every calculation felt like guesswork, and I could feel the anxiety mounting—would I overspend? Be ripped

I remember the sinking feeling in my stomach as I stood in that bustling Barcelona market, colorful stalls stretching endlessly, vendors shouting prices in rapid Spanish that blurred into noise. My hands were clammy, clutching euros that felt foreign and insufficient. I was trying to buy souvenirs for family back home, but the mental math of converting prices to USD was making my head spin. Every calculation felt like guesswork, and I could feel the anxiety mounting—would I overspend? Be ripped -

It all started when my freelance graphic design work dried up last month. Bills were piling up, and anxiety was my constant companion. I remember scrolling through job apps, feeling hopeless, until a friend mentioned trying out food delivery. That's how I stumbled upon this platform—let's call it the wheels to my wallet. Signing up was a breeze; within hours, I was approved and ready to hit the road on my old bicycle, equipped with nothing but determination and a smartphone.

It all started when my freelance graphic design work dried up last month. Bills were piling up, and anxiety was my constant companion. I remember scrolling through job apps, feeling hopeless, until a friend mentioned trying out food delivery. That's how I stumbled upon this platform—let's call it the wheels to my wallet. Signing up was a breeze; within hours, I was approved and ready to hit the road on my old bicycle, equipped with nothing but determination and a smartphone. -

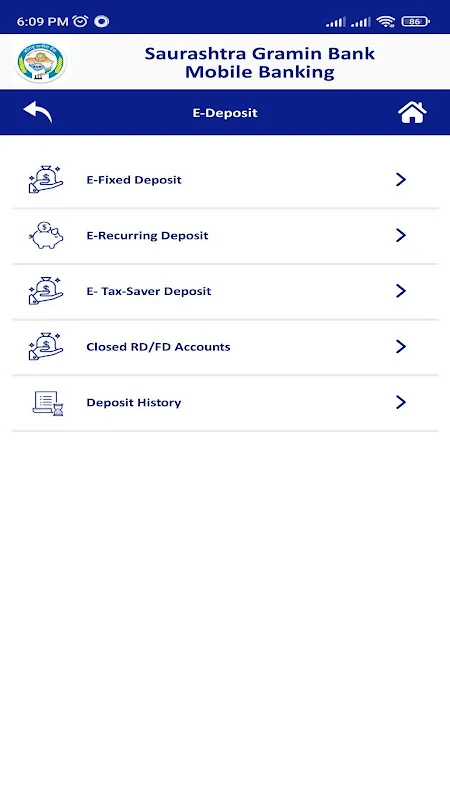

I was miles from civilization, camping in the Rockies with spotty cell service, when an email notification buzzed on my phone—my mortgage payment was due in hours, and I had completely forgotten. Panic surged through me; the nearest bank was a two-hour drive away, and I had no laptop. My heart raced as I fumbled with my phone, opening the GGB mBanking app, which I had downloaded weeks ago but never seriously used. The interface loaded slowly due to the weak signal, and for a moment, I feared it

I was miles from civilization, camping in the Rockies with spotty cell service, when an email notification buzzed on my phone—my mortgage payment was due in hours, and I had completely forgotten. Panic surged through me; the nearest bank was a two-hour drive away, and I had no laptop. My heart raced as I fumbled with my phone, opening the GGB mBanking app, which I had downloaded weeks ago but never seriously used. The interface loaded slowly due to the weak signal, and for a moment, I feared it -

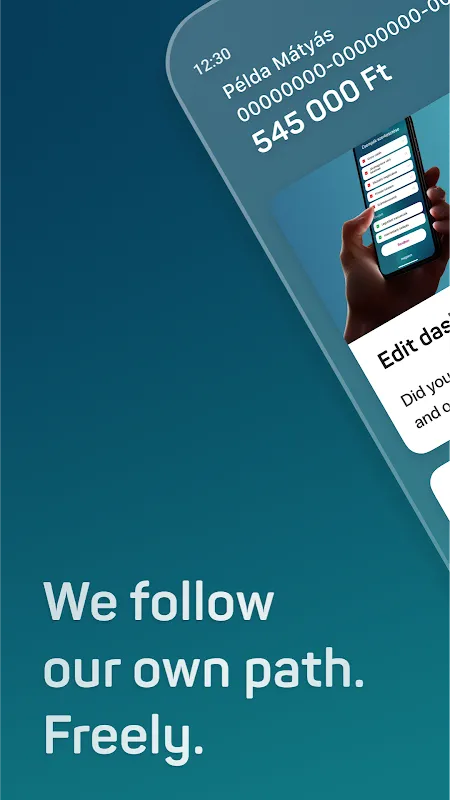

It all started on a rainy Tuesday evening in London. I was cozied up in my favorite armchair, sipping tea, when an email notification buzzed on my phone. It was from my landlord, reminding me that the rent was due—tomorrow. Panic jolted through me; I had completely forgotten amidst the chaos of work deadlines. My heart raced as I imagined the late fees and awkward explanations. But then, I remembered the MBH Bank App, tucked away on my home screen. This wasn't just any app; it had become my digi

It all started on a rainy Tuesday evening in London. I was cozied up in my favorite armchair, sipping tea, when an email notification buzzed on my phone. It was from my landlord, reminding me that the rent was due—tomorrow. Panic jolted through me; I had completely forgotten amidst the chaos of work deadlines. My heart raced as I imagined the late fees and awkward explanations. But then, I remembered the MBH Bank App, tucked away on my home screen. This wasn't just any app; it had become my digi -

I'll never forget the smell of burnt coffee and panic that hung in the air that Tuesday morning. My daughter's school trip payment was due in 90 minutes, and my bank's app had just greeted me with that spinning wheel of doom - the digital equivalent of a padlocked vault. Sweat trickled down my temple as I watched precious minutes evaporate, imagining her disappointed face when classmates boarded the bus without her. That's when Maria, our office intern, leaned over and whispered, "Try u-money -

I'll never forget the smell of burnt coffee and panic that hung in the air that Tuesday morning. My daughter's school trip payment was due in 90 minutes, and my bank's app had just greeted me with that spinning wheel of doom - the digital equivalent of a padlocked vault. Sweat trickled down my temple as I watched precious minutes evaporate, imagining her disappointed face when classmates boarded the bus without her. That's when Maria, our office intern, leaned over and whispered, "Try u-money - -

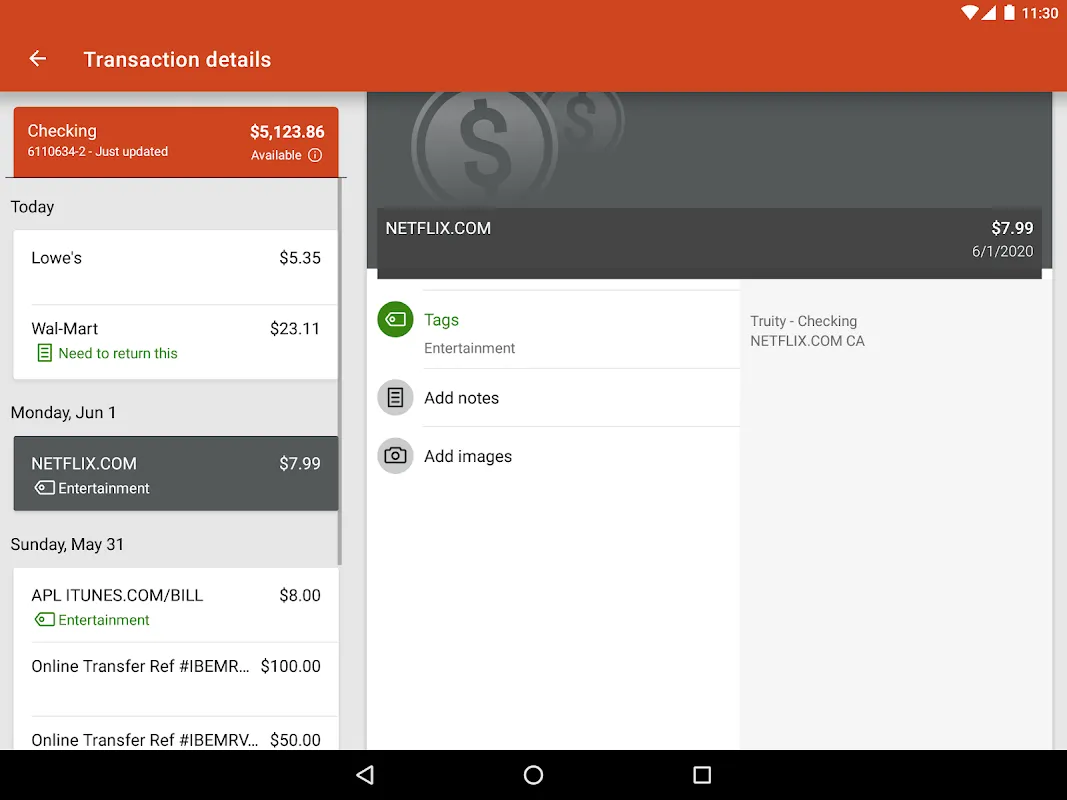

Rain lashed against the taxi window as Bangkok's neon lights blurred into watery streaks. My fingers trembled against the cracked phone screen - that sudden hotel charge notification had just drained my primary account. Frigid dread shot through me when I remembered my emergency funds were scattered across three banks back home. Pre-Truity days would've meant frantic calls to overseas helplines, password resets, and praying airport WiFi wouldn't timeout. But now? One shaky thumb-press launched w

Rain lashed against the taxi window as Bangkok's neon lights blurred into watery streaks. My fingers trembled against the cracked phone screen - that sudden hotel charge notification had just drained my primary account. Frigid dread shot through me when I remembered my emergency funds were scattered across three banks back home. Pre-Truity days would've meant frantic calls to overseas helplines, password resets, and praying airport WiFi wouldn't timeout. But now? One shaky thumb-press launched w -

Rain lashed against my rental car windshield as I white-knuckled the steering wheel along that cursed Swiss alpine pass. The engine sputtered violently before dying completely - leaving me stranded in a cloud bank with zero cell reception and dwindling daylight. Panic set in when I realized the tow truck driver only accepted instant bank transfers, waving away my credit cards with a dismissive grunt. My traditional bank app? Useless without signal, demanding layers of authentication that might a

Rain lashed against my rental car windshield as I white-knuckled the steering wheel along that cursed Swiss alpine pass. The engine sputtered violently before dying completely - leaving me stranded in a cloud bank with zero cell reception and dwindling daylight. Panic set in when I realized the tow truck driver only accepted instant bank transfers, waving away my credit cards with a dismissive grunt. My traditional bank app? Useless without signal, demanding layers of authentication that might a -

The smell of burnt toast snapped me back to reality as my trembling fingers hovered over the keyboard. There I was, 6:45 AM with oatmeal congealing in the bowl, staring at seven browser tabs of conflicting mortgage advice. My laptop screen glared back like an accusatory eye - how could I face Sarah at breakfast pretending we could afford that Craftsman bungalow? Every online calculator demanded email signups or leaked personal data like a sieve. That's when my thumb, moving on pure desperation,

The smell of burnt toast snapped me back to reality as my trembling fingers hovered over the keyboard. There I was, 6:45 AM with oatmeal congealing in the bowl, staring at seven browser tabs of conflicting mortgage advice. My laptop screen glared back like an accusatory eye - how could I face Sarah at breakfast pretending we could afford that Craftsman bungalow? Every online calculator demanded email signups or leaked personal data like a sieve. That's when my thumb, moving on pure desperation, -

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years

I remember the exact moment my hands started shaking—not from cold, but from sheer panic. It was 3 AM, rain slashing against the window like tiny financial obituaries, and I was staring at a spreadsheet so convoluted it might as well have been hieroglyphics. My daughter’s tuition deposit was due in 12 hours, and I’d just realized my "diversified" portfolio was actually a house of cards. Mutual funds? More like mutual confusion. ETFs? More like "Excruciatingly Terrible Fumbles." I’d poured years -

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban

The rhythmic thumping against my driver's side wheel well wasn't part of the road trip playlist. As I pulled over onto the muddy shoulder of Highway 87, Montana's endless pine forests suddenly felt suffocating. My '08 Jeep Cherokee shuddered to a halt just as the downpour intensified, hammering the roof like a thousand anxious fingertips. Through the fogged windshield, I watched dollar signs evaporate with every wiper swipe. The nearest tow truck? Two hours away. The repair cost? Unknown. My ban -

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism.

The metallic taste of panic flooded my mouth when my card declined at the grocery checkout last March. Three people behind me sighed as I fumbled through payment apps, realizing my entire paycheck had vanished into forgotten subscriptions and phantom charges. That night, shaking on my apartment floor with bank statements spread like autopsy reports, I downloaded Pocket Guard as a last resort. What happened next wasn't just data tracking - it was a financial exorcism. -

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone

That Thursday morning started with the familiar dread - five notifications blinking simultaneously on my phone screen like ambulance lights. Barclays demanding a payment, Monzo warning about overdraft fees, Revolut's foreign exchange alert, and two credit card reminders. My thumb trembled as I tried switching between apps, coffee cooling forgotten beside me. This wasn't banking; it was digital triage. When I accidentally paid the wrong card twice - triggering £35 in penalties - I hurled my phone