peer to peer trading 2025-10-01T00:41:59Z

-

Sunlight glared off my phone screen like a spiteful joke as I squinted at the plummeting candlesticks. My son's championship soccer match roared around me – parents screaming, cleats tearing grass, that metallic taste of adrenaline hanging thick. I'd promised Emma I wouldn't miss this goal, but the NASDAQ was hemorrhaging 300 points in real-time. My palms slicked against the phone case, heart jackhammering against my ribs. One tap. That’s all I needed to exit my tech positions before the bloodba

Sunlight glared off my phone screen like a spiteful joke as I squinted at the plummeting candlesticks. My son's championship soccer match roared around me – parents screaming, cleats tearing grass, that metallic taste of adrenaline hanging thick. I'd promised Emma I wouldn't miss this goal, but the NASDAQ was hemorrhaging 300 points in real-time. My palms slicked against the phone case, heart jackhammering against my ribs. One tap. That’s all I needed to exit my tech positions before the bloodba -

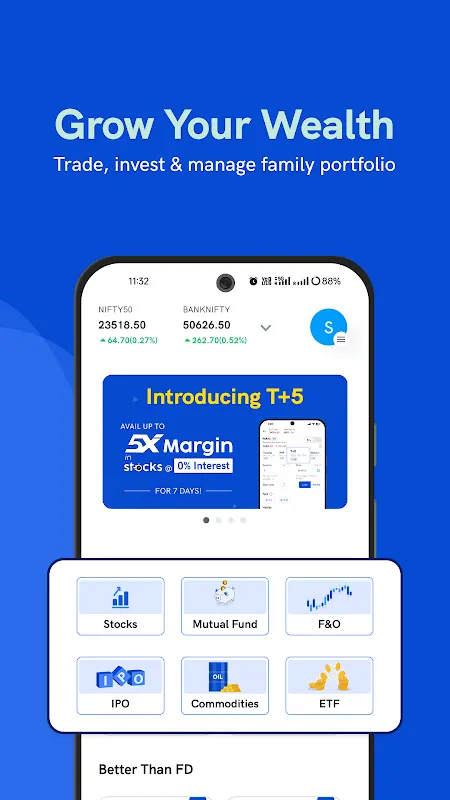

Rain lashed against my apartment window as I hunched over my phone, watching red numbers bleed across the screen. Another $47 vanished into brokerage fees that month – not from losses, but from the sheer act of trading. My thumb hovered over the "Sell" button on my old platform, paralyzed by the math: a 0.5% fee meant this move had to gain 3% just to break even. That’s when I remembered a trader friend’s drunken rant about "zero brokerage" platforms. Skeptical but desperate, I downloaded CM Capi

Rain lashed against my apartment window as I hunched over my phone, watching red numbers bleed across the screen. Another $47 vanished into brokerage fees that month – not from losses, but from the sheer act of trading. My thumb hovered over the "Sell" button on my old platform, paralyzed by the math: a 0.5% fee meant this move had to gain 3% just to break even. That’s when I remembered a trader friend’s drunken rant about "zero brokerage" platforms. Skeptical but desperate, I downloaded CM Capi -

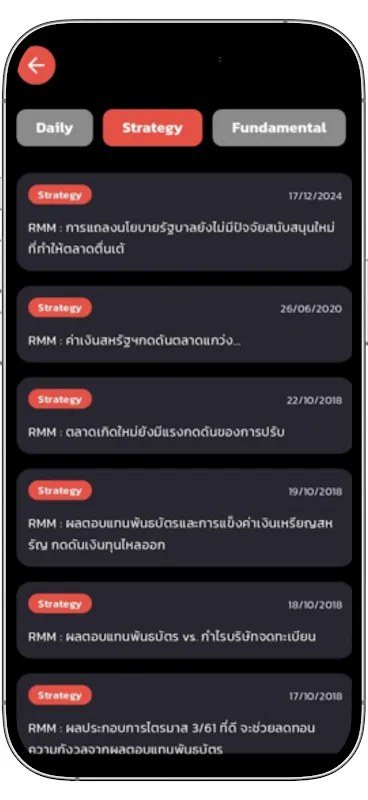

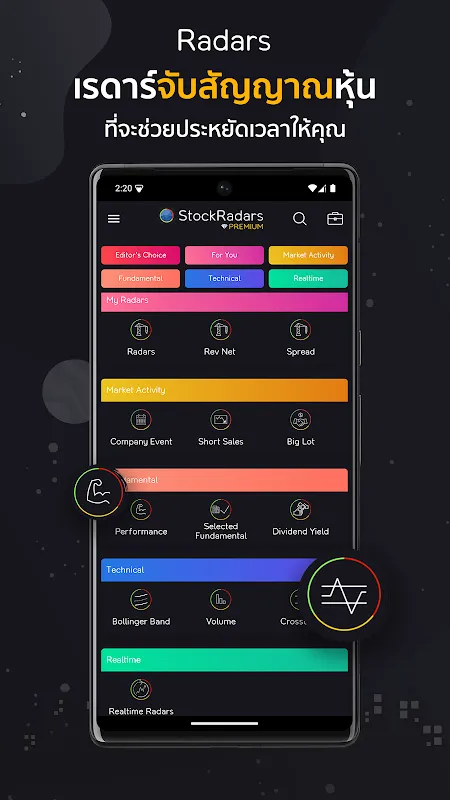

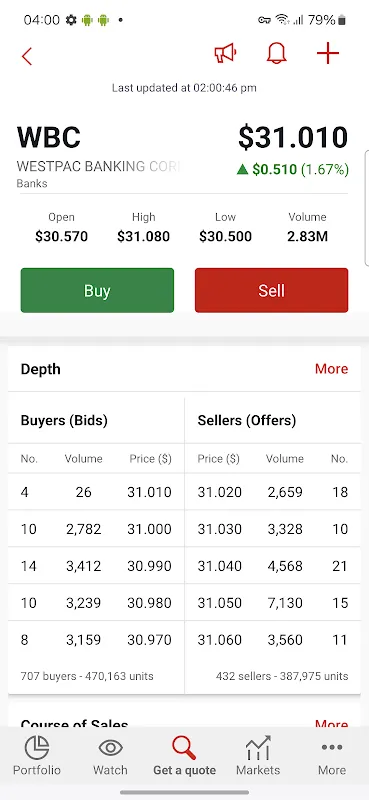

The glow of my laptop screen felt like an accusation. Spreadsheets sprawled across three monitors showed conflicting P/E ratios, dividend histories bleeding into messy tabs, while brokerage alerts blinked urgently in the corner. My index finger ached from switching windows. That Thursday night, frustration tasted like stale coffee - bitter and cold. I’d missed another earnings play because my data lived in fragmented silos. When my trembling hand finally Googled "consolidated stock tracker," Sto

The glow of my laptop screen felt like an accusation. Spreadsheets sprawled across three monitors showed conflicting P/E ratios, dividend histories bleeding into messy tabs, while brokerage alerts blinked urgently in the corner. My index finger ached from switching windows. That Thursday night, frustration tasted like stale coffee - bitter and cold. I’d missed another earnings play because my data lived in fragmented silos. When my trembling hand finally Googled "consolidated stock tracker," Sto -

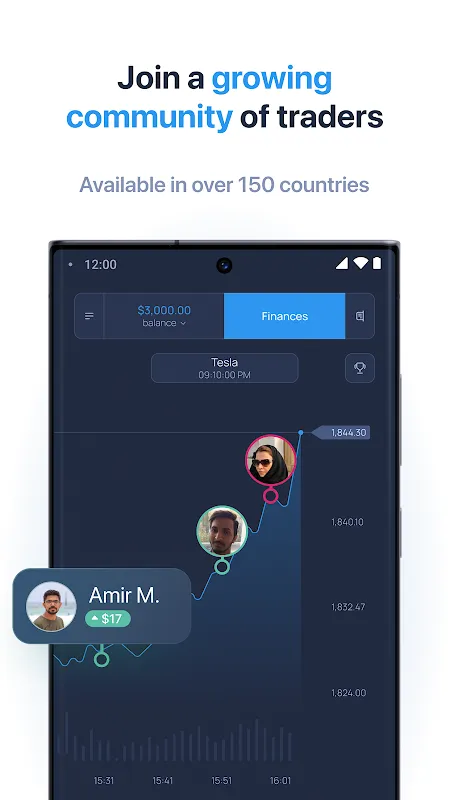

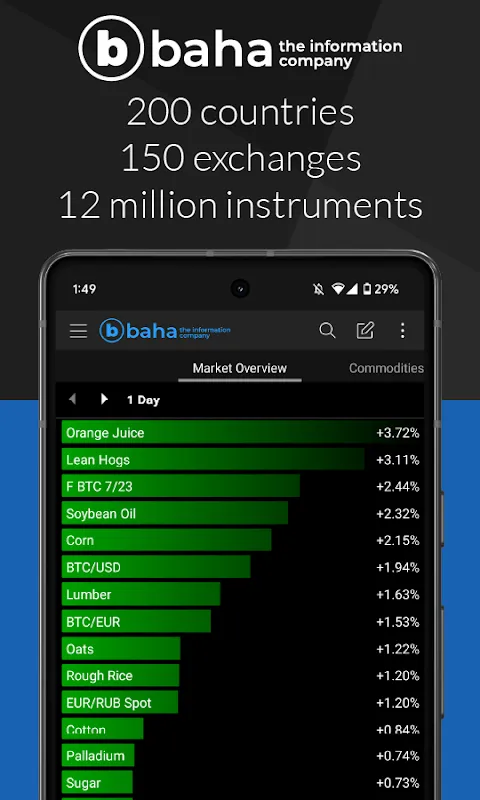

Rain lashed against my office window that Tuesday morning, mirroring the storm brewing on my trading screen. I'd just missed a crucial entry on the DAX because my platform froze—again. Fingers trembling over a keyboard slick with cold sweat, I watched potential profits evaporate while error messages mocked me. This wasn't finance; this was digital torture. That cluttered interface felt like trying to defuse a bomb with oven mitts on, every chart squished together like subway commuters at rush ho

Rain lashed against my office window that Tuesday morning, mirroring the storm brewing on my trading screen. I'd just missed a crucial entry on the DAX because my platform froze—again. Fingers trembling over a keyboard slick with cold sweat, I watched potential profits evaporate while error messages mocked me. This wasn't finance; this was digital torture. That cluttered interface felt like trying to defuse a bomb with oven mitts on, every chart squished together like subway commuters at rush ho -

Rain lashed against the departure lounge windows as I white-knuckled my phone, watching $300 evaporate because that godforsaken legacy trading platform froze during Fed announcements - again. My thumb hovered over the uninstall button when a notification sliced through the panic: "Missed opportunities? Trade global markets commission-free." Skepticism warred with desperation as I downloaded ExpertOption during that storm-delayed layover in Frankfurt.

Rain lashed against the departure lounge windows as I white-knuckled my phone, watching $300 evaporate because that godforsaken legacy trading platform froze during Fed announcements - again. My thumb hovered over the uninstall button when a notification sliced through the panic: "Missed opportunities? Trade global markets commission-free." Skepticism warred with desperation as I downloaded ExpertOption during that storm-delayed layover in Frankfurt. -

That gut-wrenching moment still haunts me - sitting in a dentist's waiting room while PharmaCorp shares skyrocketed 18% in pre-market. My sweaty palms crushed the magazine as I desperately tried accessing my brokerage through a mobile browser that kept timing out. The receptionist's clock ticked louder with each passing minute, each tick echoing the $2,300 opportunity evaporating before my eyes. When I finally got through? "Market closed for maintenance." I nearly threw my phone against the past

That gut-wrenching moment still haunts me - sitting in a dentist's waiting room while PharmaCorp shares skyrocketed 18% in pre-market. My sweaty palms crushed the magazine as I desperately tried accessing my brokerage through a mobile browser that kept timing out. The receptionist's clock ticked louder with each passing minute, each tick echoing the $2,300 opportunity evaporating before my eyes. When I finally got through? "Market closed for maintenance." I nearly threw my phone against the past -

Rain streaked across the train window like liquid regret as I watched Bitcoin surge 8% – trapped with a dead laptop and a clenched jaw. My knuckles whitened around the cold metal pole, each station stop hammering another nail into my missed opportunity. That commute felt like financial waterboarding until I installed BTC-Alpha's app in desperation, spilling coffee on my screen as the train lurched. Skepticism warred with hope: could this tiny rectangle really replace my triple-monitor trading ri

Rain streaked across the train window like liquid regret as I watched Bitcoin surge 8% – trapped with a dead laptop and a clenched jaw. My knuckles whitened around the cold metal pole, each station stop hammering another nail into my missed opportunity. That commute felt like financial waterboarding until I installed BTC-Alpha's app in desperation, spilling coffee on my screen as the train lurched. Skepticism warred with hope: could this tiny rectangle really replace my triple-monitor trading ri -

My knuckles turned bone-white gripping the phone when Bitcoin plunged 15% in minutes last April. On my old exchange, panic selling meant watching spinning wheels while my portfolio bled out - like screaming into a hurricane with no one hearing. That final $8k slippage scar made me abandon ship mid-crash, funds stranded for hours in withdrawal purgatory. The metallic taste of adrenaline still floods my mouth remembering it.

My knuckles turned bone-white gripping the phone when Bitcoin plunged 15% in minutes last April. On my old exchange, panic selling meant watching spinning wheels while my portfolio bled out - like screaming into a hurricane with no one hearing. That final $8k slippage scar made me abandon ship mid-crash, funds stranded for hours in withdrawal purgatory. The metallic taste of adrenaline still floods my mouth remembering it. -

Rain lashed against my apartment windows as I hunched over the trading terminal, that familiar knot tightening in my stomach. Another "too-good-to-be-true" broker flashed across my screen - 98% success rate, instant withdrawals, regulatory badges plastered everywhere. My finger hovered over the deposit button, still scarred from the $5,000 hemorrhage last quarter when a slick platform vanished overnight. This time felt different though; I had real-time regulatory radar humming in my pocket.

Rain lashed against my apartment windows as I hunched over the trading terminal, that familiar knot tightening in my stomach. Another "too-good-to-be-true" broker flashed across my screen - 98% success rate, instant withdrawals, regulatory badges plastered everywhere. My finger hovered over the deposit button, still scarred from the $5,000 hemorrhage last quarter when a slick platform vanished overnight. This time felt different though; I had real-time regulatory radar humming in my pocket. -

Rain lashed against the cafe windows as I sipped lukewarm coffee, celebrating my sister’s birthday. Laughter filled the air until my phone buzzed—a tsunami of red flooded global markets. My stomach dropped. Years of savings were evaporating while I sat clutching a fork. Panic clawed up my throat; I excused myself, hands trembling as I fumbled for salvation in my pocket.

Rain lashed against the cafe windows as I sipped lukewarm coffee, celebrating my sister’s birthday. Laughter filled the air until my phone buzzed—a tsunami of red flooded global markets. My stomach dropped. Years of savings were evaporating while I sat clutching a fork. Panic clawed up my throat; I excused myself, hands trembling as I fumbled for salvation in my pocket. -

My palms were sweating onto the airport terminal's plastic seats as live Fed rates flashed chaos across Bloomberg terminals. Gold was spiking - $30 up in minutes - and I was stranded with a dying laptop and unstable Wi-Fi. That metallic taste of panic? It evaporated when my thumb smashed LION CFD Android's icon. Suddenly, my cracked phone screen became a war room. Candlesticks danced in real-time, each tick mirroring the airport's departure board syncopation. I drew Fibonacci levels with one sha

My palms were sweating onto the airport terminal's plastic seats as live Fed rates flashed chaos across Bloomberg terminals. Gold was spiking - $30 up in minutes - and I was stranded with a dying laptop and unstable Wi-Fi. That metallic taste of panic? It evaporated when my thumb smashed LION CFD Android's icon. Suddenly, my cracked phone screen became a war room. Candlesticks danced in real-time, each tick mirroring the airport's departure board syncopation. I drew Fibonacci levels with one sha -

Rain lashed against the airport lounge windows as I frantically stabbed at my phone screen, watching $8,000 evaporate between delayed price updates. My usual trading setup - three different broker apps and a spreadsheet - had collapsed like a house of cards during the Fed announcement frenzy. Fingers trembling, I accidentally triggered a market sell instead of a limit order on my energy stocks. That's when Choice FinX blinked on my radar, a last-ditch Hail Mary downloaded mid-panic.

Rain lashed against the airport lounge windows as I frantically stabbed at my phone screen, watching $8,000 evaporate between delayed price updates. My usual trading setup - three different broker apps and a spreadsheet - had collapsed like a house of cards during the Fed announcement frenzy. Fingers trembling, I accidentally triggered a market sell instead of a limit order on my energy stocks. That's when Choice FinX blinked on my radar, a last-ditch Hail Mary downloaded mid-panic. -

Rain lashed against my office window as I stared at the brokerage statement - another $47 vanished into the ether of transaction fees. My knuckles whitened around the coffee mug. That commission had just erased an entire hour's market gains, a familiar gut-punch I'd grown to expect every Friday afternoon. Outside, thunder rumbled in sync with my frustration. Why did accessing the markets feel like paying highway robbery tolls just to drive on crumbling roads?

Rain lashed against my office window as I stared at the brokerage statement - another $47 vanished into the ether of transaction fees. My knuckles whitened around the coffee mug. That commission had just erased an entire hour's market gains, a familiar gut-punch I'd grown to expect every Friday afternoon. Outside, thunder rumbled in sync with my frustration. Why did accessing the markets feel like paying highway robbery tolls just to drive on crumbling roads? -

Sweat beaded on my forehead as Nasdaq futures flashed red - my entire morning coffee turned cold while I stared at my brokerage app. That $15,000 Tesla position needed immediate adjustment, but my trembling fingers kept fumbling the mental math. Commissions, exchange fees, and that cursed SEC transaction fee danced in my head like malicious sprites. I'd already lost $427 last month from miscalculated exits, each error carving deeper into my confidence.

Sweat beaded on my forehead as Nasdaq futures flashed red - my entire morning coffee turned cold while I stared at my brokerage app. That $15,000 Tesla position needed immediate adjustment, but my trembling fingers kept fumbling the mental math. Commissions, exchange fees, and that cursed SEC transaction fee danced in my head like malicious sprites. I'd already lost $427 last month from miscalculated exits, each error carving deeper into my confidence. -

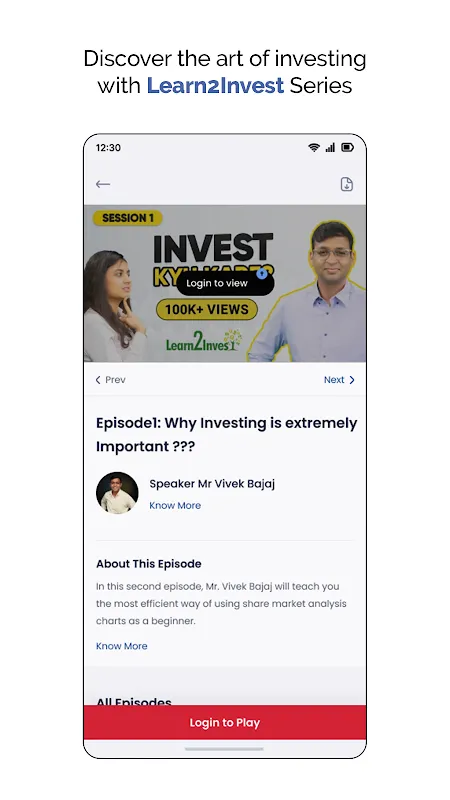

That humid Tuesday morning, I watched Reliance Industries’ chart do the tango while my coffee went cold. My thumb hovered over the "SELL" button – sweat-smeared phone screen reflecting the panic in my eyes. Another impulsive trade about to happen. Another gamble disguised as strategy. I’d become Pavlov’s dog to market volatility, salivating at every dip and spike without understanding why. Then the notification lit up my lock screen: "Live Session: Candlestick Patterns Decoded - Starting Now." E

That humid Tuesday morning, I watched Reliance Industries’ chart do the tango while my coffee went cold. My thumb hovered over the "SELL" button – sweat-smeared phone screen reflecting the panic in my eyes. Another impulsive trade about to happen. Another gamble disguised as strategy. I’d become Pavlov’s dog to market volatility, salivating at every dip and spike without understanding why. Then the notification lit up my lock screen: "Live Session: Candlestick Patterns Decoded - Starting Now." E -

I remember that Tuesday morning like it was yesterday, sitting at my cluttered desk, the stale coffee burning my tongue as I stared helplessly at my phone. The stock I'd been tracking for weeks, a promising tech startup, was plummeting during pre-market hours. My fingers trembled over the screen, but the damn quotes were frozen – a full five-minute delay, they said, due to "high volatility." By the time the app refreshed, the price had crashed 15%, and I'd lost nearly $500. Rage bubbled up in my

I remember that Tuesday morning like it was yesterday, sitting at my cluttered desk, the stale coffee burning my tongue as I stared helplessly at my phone. The stock I'd been tracking for weeks, a promising tech startup, was plummeting during pre-market hours. My fingers trembled over the screen, but the damn quotes were frozen – a full five-minute delay, they said, due to "high volatility." By the time the app refreshed, the price had crashed 15%, and I'd lost nearly $500. Rage bubbled up in my -

Rain lashed against my apartment window as I stared at the red glow of my laptop – another $19.95 vanished into the void just for moving shares between accounts. My knuckles whitened around my coffee mug. All those nights coding payment systems for banks, yet here I was getting nickel-and-dimed by the very industry I helped build. That's when my thumb brushed against the Robinhood icon by accident, a green beacon on my cluttered home screen.

Rain lashed against my apartment window as I stared at the red glow of my laptop – another $19.95 vanished into the void just for moving shares between accounts. My knuckles whitened around my coffee mug. All those nights coding payment systems for banks, yet here I was getting nickel-and-dimed by the very industry I helped build. That's when my thumb brushed against the Robinhood icon by accident, a green beacon on my cluttered home screen. -

It was 3 AM, and the London session was bleeding into New York's chaos. I sat hunched over my desk, three monitors flashing charts like strobe lights at a rave. My fingers trembled as I scribbled numbers on a notepad—average gains over 14 periods, divided by losses, multiplied by gods-know-what—trying to pin down the Relative Strength Index before the next candle closed. Sweat trickled down my temple, not from the room's heat, but from the sheer panic of missing a signal. I'd lost $500 the day b

It was 3 AM, and the London session was bleeding into New York's chaos. I sat hunched over my desk, three monitors flashing charts like strobe lights at a rave. My fingers trembled as I scribbled numbers on a notepad—average gains over 14 periods, divided by losses, multiplied by gods-know-what—trying to pin down the Relative Strength Index before the next candle closed. Sweat trickled down my temple, not from the room's heat, but from the sheer panic of missing a signal. I'd lost $500 the day b -

Rain lashed against my apartment windows like angry traders pounding on a bear market's door. I squinted at my phone's glow, the only light in my storm-drowned room at 2:47 AM. My knuckles whitened around the device as FTSE futures cratered - positions I'd opened during London hours now bleeding out in real-time. This wasn't my first overnight watch, but it was the first where panic didn't trigger my fight-or-flight. Instead, my thumb swiped left to an analytics panel revealing liquidity heatmap

Rain lashed against my apartment windows like angry traders pounding on a bear market's door. I squinted at my phone's glow, the only light in my storm-drowned room at 2:47 AM. My knuckles whitened around the device as FTSE futures cratered - positions I'd opened during London hours now bleeding out in real-time. This wasn't my first overnight watch, but it was the first where panic didn't trigger my fight-or-flight. Instead, my thumb swiped left to an analytics panel revealing liquidity heatmap -

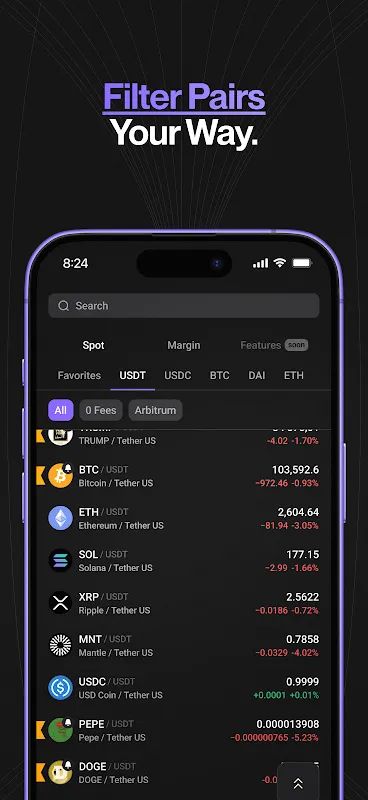

Rain lashed against the café window as my thumb jammed the refresh button for the fifth time, watching SOL's chart spike like a terrified heartbeat. Across the table, my friend's lips moved but the words dissolved into static – my entire world had tunnel-visioned to that glitching price feed. CoinGecko showed gains, Phantom wallet lagged on balance checks, and Discord pumped conflicting signals from anonymous "alpha callers." Sweat beaded under my collar despite the AC's hum; this wasn't trading

Rain lashed against the café window as my thumb jammed the refresh button for the fifth time, watching SOL's chart spike like a terrified heartbeat. Across the table, my friend's lips moved but the words dissolved into static – my entire world had tunnel-visioned to that glitching price feed. CoinGecko showed gains, Phantom wallet lagged on balance checks, and Discord pumped conflicting signals from anonymous "alpha callers." Sweat beaded under my collar despite the AC's hum; this wasn't trading