poker training 2025-10-01T08:18:08Z

-

I remember the day my screen flashed red, numbers plummeting as my heart raced. It was a typical Tuesday, but the market had other plans. I had put a significant portion of my savings into a stock that seemed promising, based on gut feeling and a few articles I skimmed. As the losses mounted, I felt a cold sweat break out, my fingers trembling over the keyboard. I was drowning in data, charts blurring into meaningless lines, and the emotional toll was crushing. That's when a friend mentioned Fin

I remember the day my screen flashed red, numbers plummeting as my heart raced. It was a typical Tuesday, but the market had other plans. I had put a significant portion of my savings into a stock that seemed promising, based on gut feeling and a few articles I skimmed. As the losses mounted, I felt a cold sweat break out, my fingers trembling over the keyboard. I was drowning in data, charts blurring into meaningless lines, and the emotional toll was crushing. That's when a friend mentioned Fin -

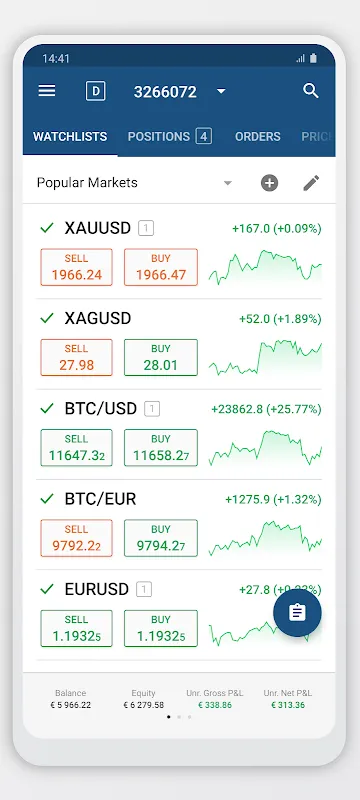

My trading desk used to resemble a warzone. Three monitors blared conflicting charts, sticky notes plastered like battle scars, and the constant ping of delayed alerts. One Wednesday, adrenaline spiked as crude oil prices started tumbling - my old platform froze mid-swing. Fingers trembling, I watched potential profits evaporate like steam. That night, I rage-deleted every trading app while rain lashed the windows. Desperation led me to CapitalBear's minimalist landing page. Downloading it felt

My trading desk used to resemble a warzone. Three monitors blared conflicting charts, sticky notes plastered like battle scars, and the constant ping of delayed alerts. One Wednesday, adrenaline spiked as crude oil prices started tumbling - my old platform froze mid-swing. Fingers trembling, I watched potential profits evaporate like steam. That night, I rage-deleted every trading app while rain lashed the windows. Desperation led me to CapitalBear's minimalist landing page. Downloading it felt -

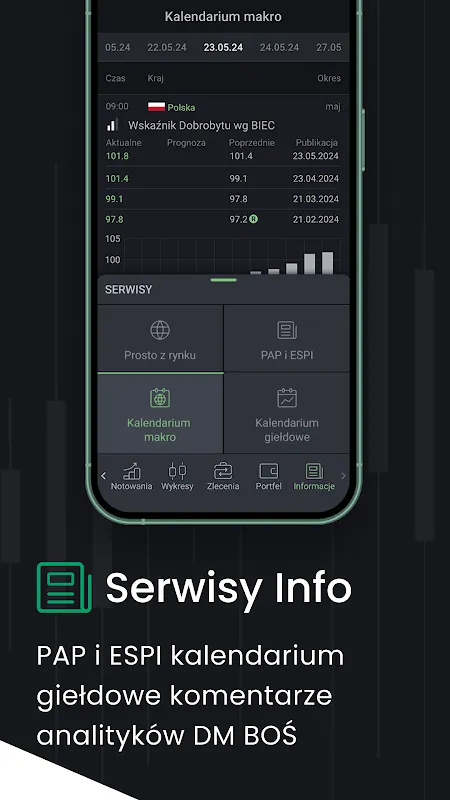

Rain lashed against the Parisian café window as my thumb cramped scrolling between brokerage apps. Frankfurt's DAX was plunging while Wall Street futures flickered erratically - my portfolio hemorrhaging value with every app switch. That's when my trembling fingers found the bossaMobile download link, a decision that transformed my phone into a war room against market chaos.

Rain lashed against the Parisian café window as my thumb cramped scrolling between brokerage apps. Frankfurt's DAX was plunging while Wall Street futures flickered erratically - my portfolio hemorrhaging value with every app switch. That's when my trembling fingers found the bossaMobile download link, a decision that transformed my phone into a war room against market chaos. -

My knuckles turned bone-white gripping the subway pole during Thursday's commute, the screeching brakes mirroring my frayed nerves. Another client rejection email glared from my phone when this circular puzzle sanctuary appeared in my app library. I'd forgotten downloading it during a midnight anxiety spiral weeks prior. Fingers trembling, I tapped open Word Search Sea - and Manhattan's chaos dissolved into concentric rings of tranquility.

My knuckles turned bone-white gripping the subway pole during Thursday's commute, the screeching brakes mirroring my frayed nerves. Another client rejection email glared from my phone when this circular puzzle sanctuary appeared in my app library. I'd forgotten downloading it during a midnight anxiety spiral weeks prior. Fingers trembling, I tapped open Word Search Sea - and Manhattan's chaos dissolved into concentric rings of tranquility. -

My apartment smelled like stale coffee and desperation that Tuesday. I'd been staring at three different brokerage apps, each flashing red numbers that mocked my portfolio. One for stocks, another for crypto, and some clunky forex thing I barely understood – it felt like juggling chainsaws while riding a unicycle. Outside, London rain blurred the streetlights into golden smears. I remember thinking: "This isn't finance; it's digital schizophrenia."

My apartment smelled like stale coffee and desperation that Tuesday. I'd been staring at three different brokerage apps, each flashing red numbers that mocked my portfolio. One for stocks, another for crypto, and some clunky forex thing I barely understood – it felt like juggling chainsaws while riding a unicycle. Outside, London rain blurred the streetlights into golden smears. I remember thinking: "This isn't finance; it's digital schizophrenia." -

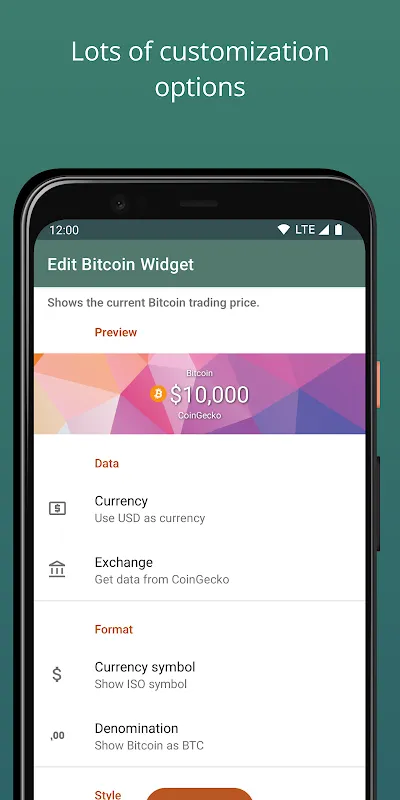

Rain lashed against the taxi window as Bangkok's neon signs bled into watery streaks. Jetlag clawed at my eyelids when the notification buzzed - ETH flash crash. My stomach dropped. All my trading apps required logins I couldn't remember through the fog of travel exhaustion. Frantic swiping through home screens felt like drowning until my thumb froze over that unassuming rectangle - Simple Crypto Widget. Suddenly, there it was: Ethereum's bloody freefall displayed in crisp, real-time numbers aga

Rain lashed against the taxi window as Bangkok's neon signs bled into watery streaks. Jetlag clawed at my eyelids when the notification buzzed - ETH flash crash. My stomach dropped. All my trading apps required logins I couldn't remember through the fog of travel exhaustion. Frantic swiping through home screens felt like drowning until my thumb froze over that unassuming rectangle - Simple Crypto Widget. Suddenly, there it was: Ethereum's bloody freefall displayed in crisp, real-time numbers aga -

My fingers trembled against the cold glass as the Nikkei plunged 4% overnight. Three monitors glared back with contradictory data – TD Ameritrade showed margin calls while Interactive Brokers displayed phantom gains. I choked on lukewarm coffee, tasting acid and adrenaline as I scrambled between password managers. That’s when my thumb accidentally launched HabitTrade. Suddenly, a unified dashboard crystallized the chaos: real-time syncing across every broker transformed eight red alerts into one

My fingers trembled against the cold glass as the Nikkei plunged 4% overnight. Three monitors glared back with contradictory data – TD Ameritrade showed margin calls while Interactive Brokers displayed phantom gains. I choked on lukewarm coffee, tasting acid and adrenaline as I scrambled between password managers. That’s when my thumb accidentally launched HabitTrade. Suddenly, a unified dashboard crystallized the chaos: real-time syncing across every broker transformed eight red alerts into one -

Rain lashed against my Berlin apartment window like disapproving whispers. Six months in this gray city and I still hadn't found that electric hum of human connection - until my thumb accidentally tapped the app store icon while scrolling through old photos of Cairo coffeehouses. There it was: Domino Cafe - 8 Ball glowing on screen like a misplaced sunbeam. I downloaded it with the cynical chuckle of someone who'd tried seven "cultural connection" apps that felt as authentic as plastic baklava.

Rain lashed against my Berlin apartment window like disapproving whispers. Six months in this gray city and I still hadn't found that electric hum of human connection - until my thumb accidentally tapped the app store icon while scrolling through old photos of Cairo coffeehouses. There it was: Domino Cafe - 8 Ball glowing on screen like a misplaced sunbeam. I downloaded it with the cynical chuckle of someone who'd tried seven "cultural connection" apps that felt as authentic as plastic baklava. -

The scent of stale coffee and panic still claws at my memory whenever I pass a brokerage office. That Tuesday morning when my entire $800 position evaporated faster than steam off a latte – the gut punch that left me hunched over my phone, watching red numbers bleed across the screen like fresh wounds. Real money. Real loss. Real terror that froze my fingers mid-tap, terrified to exit the trade because what if it rebounded? What if I locked in failure? My knuckles turned bone-white gripping that

The scent of stale coffee and panic still claws at my memory whenever I pass a brokerage office. That Tuesday morning when my entire $800 position evaporated faster than steam off a latte – the gut punch that left me hunched over my phone, watching red numbers bleed across the screen like fresh wounds. Real money. Real loss. Real terror that froze my fingers mid-tap, terrified to exit the trade because what if it rebounded? What if I locked in failure? My knuckles turned bone-white gripping that -

My palms were slick with cold sweat, thumb trembling as it hovered over the phone screen. Outside, Mumbai's monsoon rain hammered against the window like frantic fingers tapping for entry - nature's cruel echo of my racing heartbeat. ETH had just nosedived 18% in seven minutes. Margin calls were devouring my portfolio like piranhas, and every exchange app I frantically swiped through either froze at login or demanded KYC verification I couldn't process with shaking hands. That's when the notific

My palms were slick with cold sweat, thumb trembling as it hovered over the phone screen. Outside, Mumbai's monsoon rain hammered against the window like frantic fingers tapping for entry - nature's cruel echo of my racing heartbeat. ETH had just nosedived 18% in seven minutes. Margin calls were devouring my portfolio like piranhas, and every exchange app I frantically swiped through either froze at login or demanded KYC verification I couldn't process with shaking hands. That's when the notific -

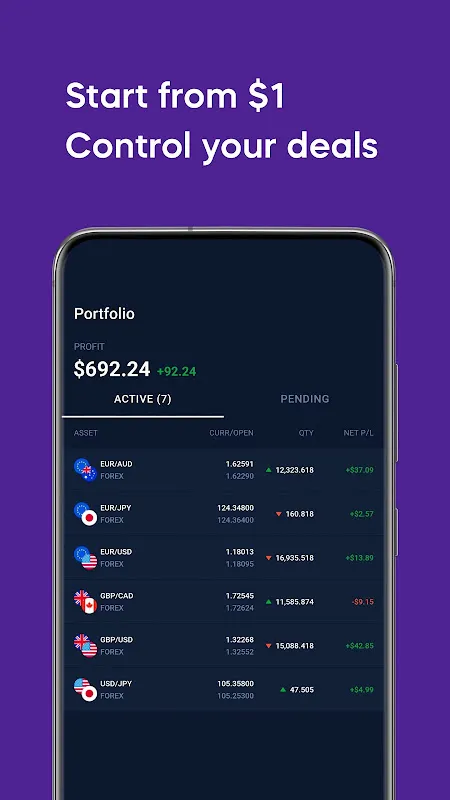

That sweltering afternoon in the quaint Barcelona café, sipping espresso while markets imploded, is etched into my memory like a jagged scar. I was supposed to be on holiday, unwinding from months of desk-bound trading, but news of a sudden interest rate hike shattered the calm. My phone buzzed incessantly—alerts screaming about my EUR/USD position tanking. Panic clawed at my throat, cold sweat beading on my forehead as I fumbled with my old trading app, a relic of frustration. Its laggy charts

That sweltering afternoon in the quaint Barcelona café, sipping espresso while markets imploded, is etched into my memory like a jagged scar. I was supposed to be on holiday, unwinding from months of desk-bound trading, but news of a sudden interest rate hike shattered the calm. My phone buzzed incessantly—alerts screaming about my EUR/USD position tanking. Panic clawed at my throat, cold sweat beading on my forehead as I fumbled with my old trading app, a relic of frustration. Its laggy charts -

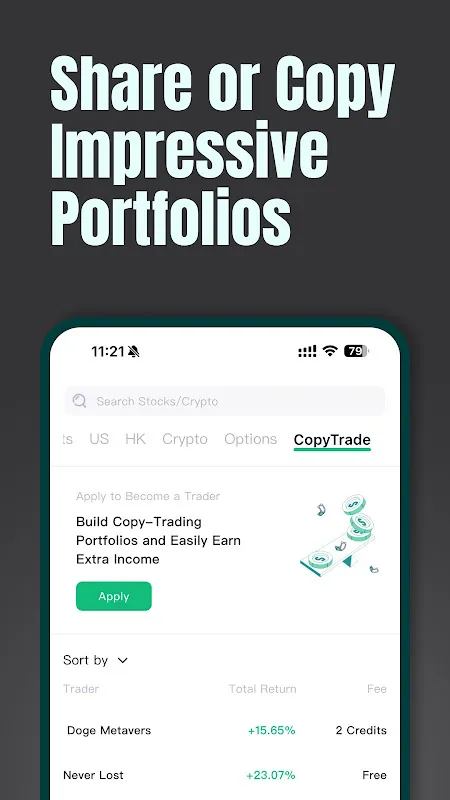

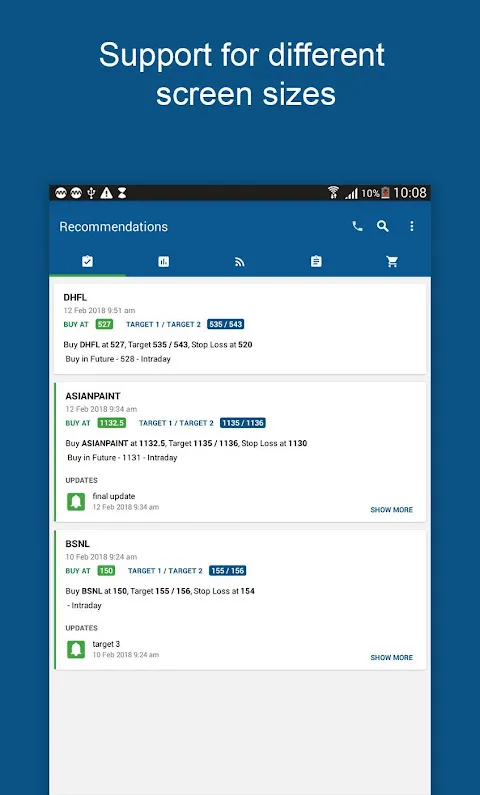

That Tuesday morning smelled like burnt coffee and impending doom. My brokerage app glared back—a constellation of red—as silver futures cratered 8% pre-market. I’d spent nights dissecting MACD crossovers like sacred texts, only to watch algorithms shred my strategy. Fingers numb, I deleted three trading apps in rage before stumbling upon it: Share4you. Not a guru’s promise, but a quiet revolution. "Mirror real traders," the description whispered. My last $500 hovered over the deposit button.

That Tuesday morning smelled like burnt coffee and impending doom. My brokerage app glared back—a constellation of red—as silver futures cratered 8% pre-market. I’d spent nights dissecting MACD crossovers like sacred texts, only to watch algorithms shred my strategy. Fingers numb, I deleted three trading apps in rage before stumbling upon it: Share4you. Not a guru’s promise, but a quiet revolution. "Mirror real traders," the description whispered. My last $500 hovered over the deposit button. -

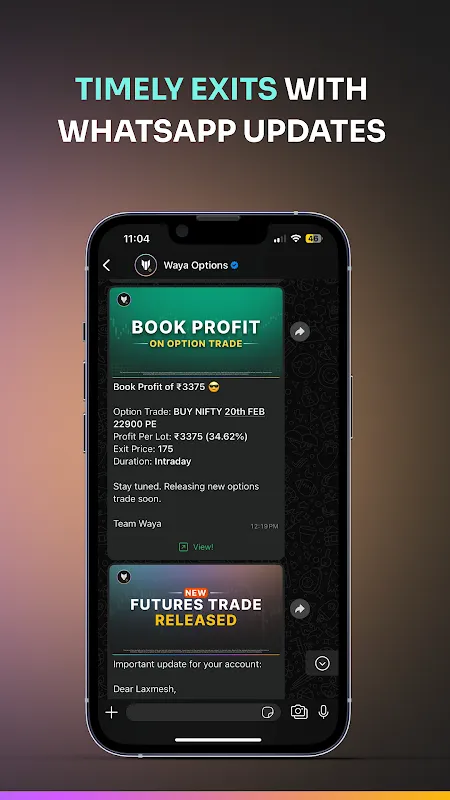

I still taste the metallic tang of panic from that Thursday morning. Gold futures were hemorrhaging value like a slit artery, and my index finger hovered over the SELL button as cold sweat dripped down my temple. Three months prior, I'd have liquidated everything in that blind terror – just like when I wiped out 40% of my portfolio during the silver squeeze. But now, Waya Futures and Options hummed quietly on my tablet, its machine learning algorithms digesting centuries of market psychology and

I still taste the metallic tang of panic from that Thursday morning. Gold futures were hemorrhaging value like a slit artery, and my index finger hovered over the SELL button as cold sweat dripped down my temple. Three months prior, I'd have liquidated everything in that blind terror – just like when I wiped out 40% of my portfolio during the silver squeeze. But now, Waya Futures and Options hummed quietly on my tablet, its machine learning algorithms digesting centuries of market psychology and -

Rain lashed against the flimsy tent fabric like a thousand impatient fingers. Somewhere in the Blue Ridge Mountains, stranded on day three of a washed-out hiking trip, I felt the familiar acid burn of panic rise in my throat. Not from the storm, but from the Bloomberg alert buzzing against my hip: MARKET FLASH CRASH - TECH SECTOR PLUMMETS. My entire portfolio, years of grinding savings, was evaporating into digital ether while I sat in a puddle of mud with 12% phone battery and a single bar of s

Rain lashed against the flimsy tent fabric like a thousand impatient fingers. Somewhere in the Blue Ridge Mountains, stranded on day three of a washed-out hiking trip, I felt the familiar acid burn of panic rise in my throat. Not from the storm, but from the Bloomberg alert buzzing against my hip: MARKET FLASH CRASH - TECH SECTOR PLUMMETS. My entire portfolio, years of grinding savings, was evaporating into digital ether while I sat in a puddle of mud with 12% phone battery and a single bar of s -

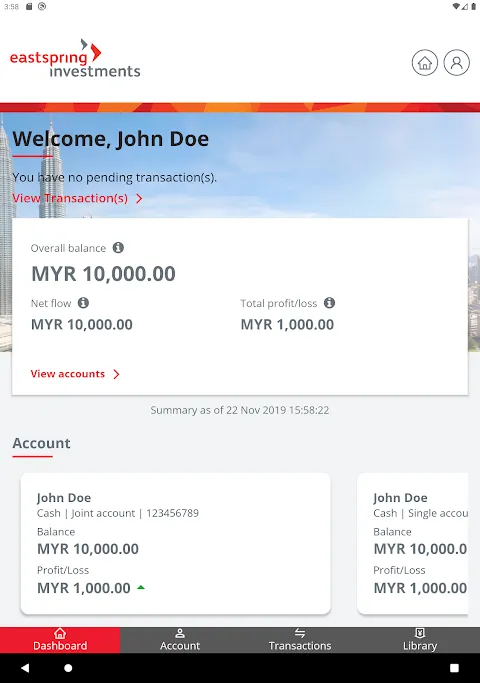

Sweat trickled down my temple as the Tokyo Nikkei index plummeted during my daughter's ballet recital. Frustration clawed at my throat - another market tsunami I'd witness helplessly from auditorium darkness. Before myEastspring, I'd missed three major opportunities just this quarter, trapped by family obligations and corporate firewall prisons. That helpless rage when your portfolio bleeds out while you applaud pirouettes? It stains your soul.

Sweat trickled down my temple as the Tokyo Nikkei index plummeted during my daughter's ballet recital. Frustration clawed at my throat - another market tsunami I'd witness helplessly from auditorium darkness. Before myEastspring, I'd missed three major opportunities just this quarter, trapped by family obligations and corporate firewall prisons. That helpless rage when your portfolio bleeds out while you applaud pirouettes? It stains your soul. -

That Tuesday morning smelled like burnt coffee and desperation. I'd been staring at six flickering monitors since 4 AM, cortisol pumping through me as EUR/USD charts convulsed like a dying animal. My usual toolkit—candlestick patterns, Fibonacci retracements, RSI oscillators—felt like trying to perform open-heart surgery with a butter knife. Every alert from my trading platform triggered a Pavlovian panic; I was drowning in data vomit. Then, at 8:47 AM, my phone buzzed—not with another soul-crus

That Tuesday morning smelled like burnt coffee and desperation. I'd been staring at six flickering monitors since 4 AM, cortisol pumping through me as EUR/USD charts convulsed like a dying animal. My usual toolkit—candlestick patterns, Fibonacci retracements, RSI oscillators—felt like trying to perform open-heart surgery with a butter knife. Every alert from my trading platform triggered a Pavlovian panic; I was drowning in data vomit. Then, at 8:47 AM, my phone buzzed—not with another soul-crus -

VT Markets - Trading AppVT Markets is a globally recognized, regulated platform serving clients from over 160 countries. Our advanced platforms offer seamless access to a wide array of global financial markets.Experience the convenience of trading anytime, anywhere with the VT Markets App, providing access to over 1,000 financial instruments.The VT Markets App allows you to efficiently manage your portfolio, facilitate transactions, and leverage an extensive suite of tools. Benefit from current

VT Markets - Trading AppVT Markets is a globally recognized, regulated platform serving clients from over 160 countries. Our advanced platforms offer seamless access to a wide array of global financial markets.Experience the convenience of trading anytime, anywhere with the VT Markets App, providing access to over 1,000 financial instruments.The VT Markets App allows you to efficiently manage your portfolio, facilitate transactions, and leverage an extensive suite of tools. Benefit from current -

Sweat trickled down my temple as I squinted against the midday sun, trying to balance lukewarm coffee while cheering at my son's championship game. The roar of parents around me faded into white noise when my watch buzzed - crude oil prices were collapsing faster than a sandcastle at high tide. My gut clenched. This was the volatility play I'd prepared for all week, yet here I stood trapped between soccer field chains and parental obligations. My entire trading setup was 20 miles away, gathering

Sweat trickled down my temple as I squinted against the midday sun, trying to balance lukewarm coffee while cheering at my son's championship game. The roar of parents around me faded into white noise when my watch buzzed - crude oil prices were collapsing faster than a sandcastle at high tide. My gut clenched. This was the volatility play I'd prepared for all week, yet here I stood trapped between soccer field chains and parental obligations. My entire trading setup was 20 miles away, gathering -

Rain lashed against the cafe window as my thumb hovered over the sell button, heartbeat syncing with the ticking clock. Apple's earnings drop had just hit the wires, and my entire portfolio balance flashed crimson. My old trading platform - that digital relic - chose that moment to develop the spinning wheel of doom. "Loading market data," it lied, while real-time losses piled up like wreckage. That's when I remembered the blue icon buried in my second home screen folder, installed during a late

Rain lashed against the cafe window as my thumb hovered over the sell button, heartbeat syncing with the ticking clock. Apple's earnings drop had just hit the wires, and my entire portfolio balance flashed crimson. My old trading platform - that digital relic - chose that moment to develop the spinning wheel of doom. "Loading market data," it lied, while real-time losses piled up like wreckage. That's when I remembered the blue icon buried in my second home screen folder, installed during a late -

My trading desk looked like a war zone that Tuesday morning. Half-drunk coffee cups formed precarious towers beside three glowing monitors, each flashing disjointed numbers from HOSE and HASTC. Sweat glued my shirt to the chair as I alt-tabbed between brokerage portals, my cursor trembling over buy orders while VN-Index swung wildly. One moment, steel stocks surged; the next, real estate plunged. I missed a critical Hoa Phat Group dip because my browser froze mid-refresh—just another casualty in

My trading desk looked like a war zone that Tuesday morning. Half-drunk coffee cups formed precarious towers beside three glowing monitors, each flashing disjointed numbers from HOSE and HASTC. Sweat glued my shirt to the chair as I alt-tabbed between brokerage portals, my cursor trembling over buy orders while VN-Index swung wildly. One moment, steel stocks surged; the next, real estate plunged. I missed a critical Hoa Phat Group dip because my browser froze mid-refresh—just another casualty in