cryptocurrency volatility 2025-11-06T18:38:09Z

-

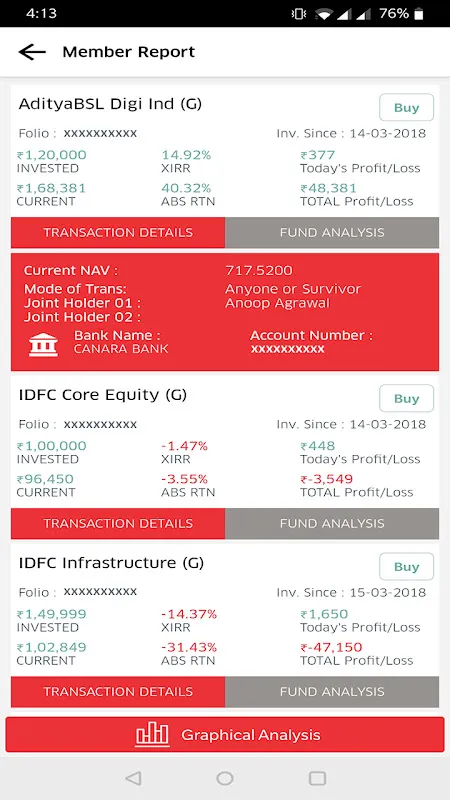

Rain lashed against the window as I stared at my laptop screen, trembling fingers hovering over the "sell all" button. My life savings – tangled in mutual funds I barely understood – were bleeding red after the market crash. That's when Honey Money Dhani's notification pulsed on my phone: Portfolio health alert: Short-term volatility detected. Review strategy? The warm amber interface glowed in my dim apartment, a lighthouse in my financial storm. I tapped the risk-analysis widget, watching real

Rain lashed against the window as I stared at my laptop screen, trembling fingers hovering over the "sell all" button. My life savings – tangled in mutual funds I barely understood – were bleeding red after the market crash. That's when Honey Money Dhani's notification pulsed on my phone: Portfolio health alert: Short-term volatility detected. Review strategy? The warm amber interface glowed in my dim apartment, a lighthouse in my financial storm. I tapped the risk-analysis widget, watching real -

Rain lashed against my apartment windows that Tuesday evening, mirroring the storm inside my head. I'd just received the email – my freelance contract wasn't being renewed after three steady years. Panic slithered up my spine as I mentally calculated rent deadlines against an empty calendar. My usual coping mechanism – obsessively refreshing stock apps – only deepened the nausea. Red arrows mocked me like bleeding wounds across the screen. That's when the push notification blinked: Quarterly dis

Rain lashed against my apartment windows that Tuesday evening, mirroring the storm inside my head. I'd just received the email – my freelance contract wasn't being renewed after three steady years. Panic slithered up my spine as I mentally calculated rent deadlines against an empty calendar. My usual coping mechanism – obsessively refreshing stock apps – only deepened the nausea. Red arrows mocked me like bleeding wounds across the screen. That's when the push notification blinked: Quarterly dis -

Rain lashed against my office window that Tuesday morning, mirroring the storm inside my chest. I’d just seen the Bloomberg alert – market carnage, 5% drop overnight. My hands shook scrolling through seven different brokerage apps, each showing fragmented slices of my crumbling portfolio. That sinking feeling returned: the dread of not knowing if I should panic-sell or ride it out. Retirement dreams felt like sand slipping through my fingers. Then I remembered the discreet email from Jalan Finan

Rain lashed against my office window that Tuesday morning, mirroring the storm inside my chest. I’d just seen the Bloomberg alert – market carnage, 5% drop overnight. My hands shook scrolling through seven different brokerage apps, each showing fragmented slices of my crumbling portfolio. That sinking feeling returned: the dread of not knowing if I should panic-sell or ride it out. Retirement dreams felt like sand slipping through my fingers. Then I remembered the discreet email from Jalan Finan -

Sweat prickled my collar as Nasdaq futures flashed crimson on every screen in the brokerage office. That sickening 3% pre-market plunge wasn't just numbers - it was my entire Q3 profits evaporating before the opening bell. My thumb trembled over the outdated trading app I'd tolerated for years, its laggy interface mocking me with spinning load icons while precious seconds bled away. I needed to hedge my tech positions now, but the options chain looked like hieroglyphics scrambled by a drunk inte

Sweat prickled my collar as Nasdaq futures flashed crimson on every screen in the brokerage office. That sickening 3% pre-market plunge wasn't just numbers - it was my entire Q3 profits evaporating before the opening bell. My thumb trembled over the outdated trading app I'd tolerated for years, its laggy interface mocking me with spinning load icons while precious seconds bled away. I needed to hedge my tech positions now, but the options chain looked like hieroglyphics scrambled by a drunk inte -

Rain lashed against my apartment windows as the Nikkei futures cratered before dawn. That metallic taste of fear flooded my mouth when I saw my leveraged position bleeding out. My thumb jerked erratically over the broker's sell button like a misfiring piston, but the app froze mid-swipe - another victim of pre-market volatility. Three years of grinding gains evaporated in minutes while my coffee went cold beside trembling hands. This wasn't investing; it was Russian roulette with margin calls.

Rain lashed against my apartment windows as the Nikkei futures cratered before dawn. That metallic taste of fear flooded my mouth when I saw my leveraged position bleeding out. My thumb jerked erratically over the broker's sell button like a misfiring piston, but the app froze mid-swipe - another victim of pre-market volatility. Three years of grinding gains evaporated in minutes while my coffee went cold beside trembling hands. This wasn't investing; it was Russian roulette with margin calls. -

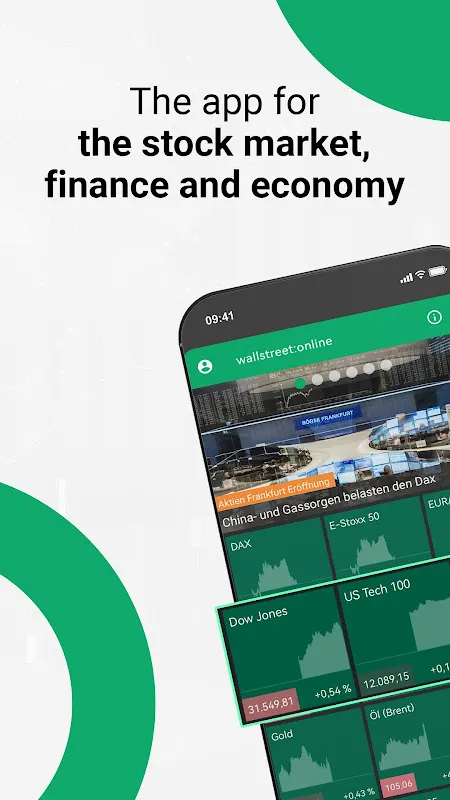

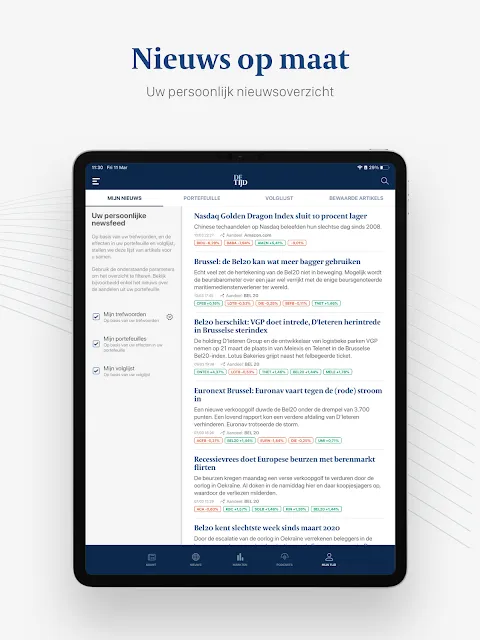

That Tuesday morning smelled like burnt coffee and impending disaster. I stared at my laptop's triple-monitor setup, each screen vomiting crimson numbers as futures plummeted 800 points pre-market. My thumb automatically began its frantic dance - swiping between Bloomberg, CNBC, and three brokerage apps - a ritual that left my phone warm with panic. Then the vibration hit my palm like an electric jolt. Not the generic market alert spam, but a hyper-specific pulse from Stock Market & Finance News

That Tuesday morning smelled like burnt coffee and impending disaster. I stared at my laptop's triple-monitor setup, each screen vomiting crimson numbers as futures plummeted 800 points pre-market. My thumb automatically began its frantic dance - swiping between Bloomberg, CNBC, and three brokerage apps - a ritual that left my phone warm with panic. Then the vibration hit my palm like an electric jolt. Not the generic market alert spam, but a hyper-specific pulse from Stock Market & Finance News -

Rain lashed against the window as Bloomberg flashed red numbers that felt like physical blows. My throat tightened - that nauseating cocktail of adrenaline and dread only a free-falling market can brew. Where did I stand? My mind raced through fragmented Excel sheets, quarterly PDF statements buried in email abysses, that vague recollection of a bond allocation... useless. Sweat beaded on my palm as I fumbled for my phone, the cold glass a stark contrast to my panic. Then I remembered: the advis

Rain lashed against the window as Bloomberg flashed red numbers that felt like physical blows. My throat tightened - that nauseating cocktail of adrenaline and dread only a free-falling market can brew. Where did I stand? My mind raced through fragmented Excel sheets, quarterly PDF statements buried in email abysses, that vague recollection of a bond allocation... useless. Sweat beaded on my palm as I fumbled for my phone, the cold glass a stark contrast to my panic. Then I remembered: the advis -

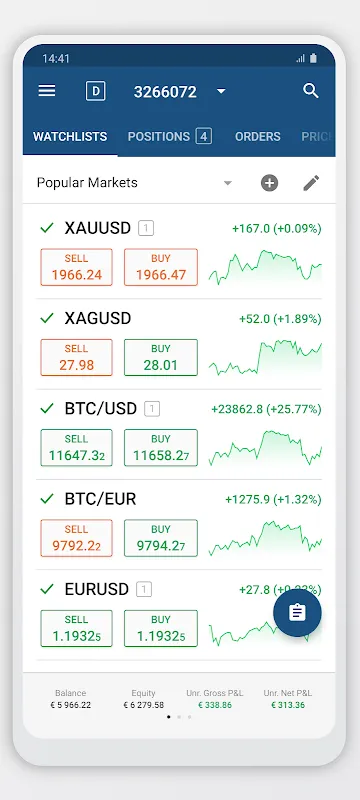

Sweat glued my shirt to the leather chair as Bloomberg and CNBC screamed conflicting headlines. That Tuesday morning smelled like burnt coffee and panic - the Swiss National Bank had just pulled the rug on euro pegging. My portfolio bled crimson across three monitors while Reuters lagged 47 seconds behind reality. Fingers trembling over sell orders, I realized I was navigating a hurricane with a broken compass. Then my phone buzzed - not the usual spam, but a visceral vibration pattern I'd come

Sweat glued my shirt to the leather chair as Bloomberg and CNBC screamed conflicting headlines. That Tuesday morning smelled like burnt coffee and panic - the Swiss National Bank had just pulled the rug on euro pegging. My portfolio bled crimson across three monitors while Reuters lagged 47 seconds behind reality. Fingers trembling over sell orders, I realized I was navigating a hurricane with a broken compass. Then my phone buzzed - not the usual spam, but a visceral vibration pattern I'd come -

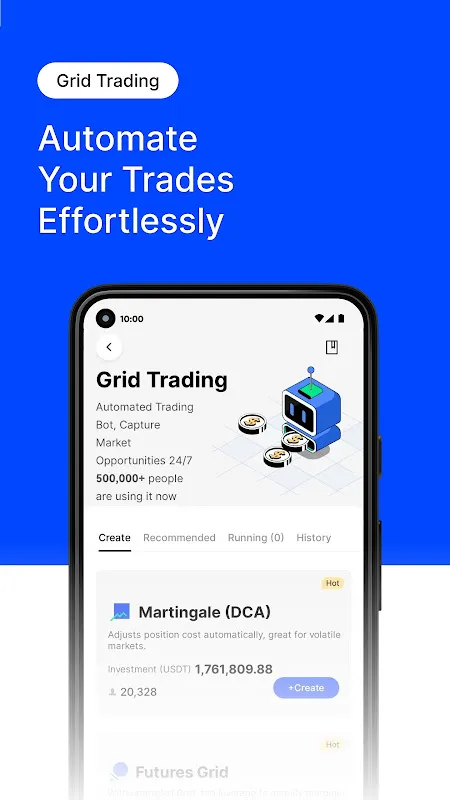

Rain lashed against my apartment windows as the Bitcoin chart bled crimson on my third monitor. I’d been hypnotized for hours watching my portfolio evaporate—$18,000 dissolving like sugar in boiling water. My fingers trembled over the keyboard, caught between panic-selling and suicidal diamond-hand stubbornness. That’s when the notification sliced through the chaos: *ping*. A stranger named "CryptoViking79" had just opened a 125x leveraged short on ETH. My thumb hovered, heartbeat syncing with t

Rain lashed against my apartment windows as the Bitcoin chart bled crimson on my third monitor. I’d been hypnotized for hours watching my portfolio evaporate—$18,000 dissolving like sugar in boiling water. My fingers trembled over the keyboard, caught between panic-selling and suicidal diamond-hand stubbornness. That’s when the notification sliced through the chaos: *ping*. A stranger named "CryptoViking79" had just opened a 125x leveraged short on ETH. My thumb hovered, heartbeat syncing with t -

The alarm blares at 4:45 AM London time, but my eyes are already glued to the three flickering screens. FTSE futures are cratering after Asian markets panicked over manufacturing data, and my legacy trading platform chooses this moment to freeze. I’m jamming the refresh button like a madman, watching potential profits evaporate between pixelated loading bars. Sweat soaks my collar as error messages pop up – position calculations failed – while margin warnings scream in crimson. This isn’t tradin

The alarm blares at 4:45 AM London time, but my eyes are already glued to the three flickering screens. FTSE futures are cratering after Asian markets panicked over manufacturing data, and my legacy trading platform chooses this moment to freeze. I’m jamming the refresh button like a madman, watching potential profits evaporate between pixelated loading bars. Sweat soaks my collar as error messages pop up – position calculations failed – while margin warnings scream in crimson. This isn’t tradin -

Rain lashed against the rental car windshield as I navigated single-track roads through Glencoe, my knuckles white on the steering wheel. I'd promised my wife this hiking trip would be a complete market detox - no charts, no positions, just mountains and midges. But when my phone erupted with five consecutive Bloomberg alerts during a pit stop at some godforsaken petrol station, the pit in my stomach returned. The Swiss National Bank had just made an unexpected move, and my EUR/CHF position was

Rain lashed against the rental car windshield as I navigated single-track roads through Glencoe, my knuckles white on the steering wheel. I'd promised my wife this hiking trip would be a complete market detox - no charts, no positions, just mountains and midges. But when my phone erupted with five consecutive Bloomberg alerts during a pit stop at some godforsaken petrol station, the pit in my stomach returned. The Swiss National Bank had just made an unexpected move, and my EUR/CHF position was -

Rain lashed against my apartment windows as I stared at the glowing screen, fingers trembling over the "SELL" button. My real trading account had bled out just hours earlier - another victim of my impulsive Euro short. That's when I discovered this digital sanctuary disguised as a game. The simulator didn't just replicate markets; it replicated the cold sweat on my palms and that metallic taste of panic when positions turn. My first virtual trade mimicked my disastrous real one: same currency pa

Rain lashed against my apartment windows as I stared at the glowing screen, fingers trembling over the "SELL" button. My real trading account had bled out just hours earlier - another victim of my impulsive Euro short. That's when I discovered this digital sanctuary disguised as a game. The simulator didn't just replicate markets; it replicated the cold sweat on my palms and that metallic taste of panic when positions turn. My first virtual trade mimicked my disastrous real one: same currency pa -

Rain lashed against my apartment windows at 4:37 AM when the Bloomberg alert shattered the silence – pre-market futures were tanking hard. My throat tightened as I fumbled for my phone, knocking over yesterday's cold coffee. That sticky mess felt like my portfolio looked when I finally loaded my trading account. Red everywhere. My index fund positions bled 11% before sunrise, and all I could think about was that margin call waiting to gut me.

Rain lashed against my apartment windows at 4:37 AM when the Bloomberg alert shattered the silence – pre-market futures were tanking hard. My throat tightened as I fumbled for my phone, knocking over yesterday's cold coffee. That sticky mess felt like my portfolio looked when I finally loaded my trading account. Red everywhere. My index fund positions bled 11% before sunrise, and all I could think about was that margin call waiting to gut me. -

Rain lashed against my office window as the Nikkei index began its freefall last Tuesday morning. That metallic tang of panic flooded my mouth - the same taste I'd known during the '08 crash. My trembling fingers left smudges on the tablet screen as I scrambled for answers. Then I remembered the crimson icon tucked in my folder. Launching Barron's app felt like deploying a financial defibrillator. Within seconds, live yield curves pulsed before me, not as sterile numbers but as living organisms

Rain lashed against my office window as the Nikkei index began its freefall last Tuesday morning. That metallic tang of panic flooded my mouth - the same taste I'd known during the '08 crash. My trembling fingers left smudges on the tablet screen as I scrambled for answers. Then I remembered the crimson icon tucked in my folder. Launching Barron's app felt like deploying a financial defibrillator. Within seconds, live yield curves pulsed before me, not as sterile numbers but as living organisms -

That Tuesday morning still burns in my memory – rain smearing the skyscraper windows as I frantically juggled four browser tabs. My brokerage login failed for the third time while Asian markets bled red, and I missed rebalancing my Singapore REITs by 27 minutes. The $8,000 oversight felt like swallowing broken glass. For years, this fractured ritual defined my pre-dawn hours: password resets, spreadsheet gymnastics, and that hollow dread of flying blind through financial storms.

That Tuesday morning still burns in my memory – rain smearing the skyscraper windows as I frantically juggled four browser tabs. My brokerage login failed for the third time while Asian markets bled red, and I missed rebalancing my Singapore REITs by 27 minutes. The $8,000 oversight felt like swallowing broken glass. For years, this fractured ritual defined my pre-dawn hours: password resets, spreadsheet gymnastics, and that hollow dread of flying blind through financial storms. -

Rain lashed against the café window as I stabbed at my phone screen, frustration tightening my throat. Another spreadsheet error – this time a miscalculated compound interest formula that vaporized $1,200 of imaginary returns. My hands smelled like stale coffee and desperation. That's when SMIFS Mutual Funds ambushed me through a finance podcast ad. Skeptical? Absolutely. But three days later, watching my fragmented Fidelity holdings, Vanguard IRAs, and even that forgotten Treasury bond material

Rain lashed against the café window as I stabbed at my phone screen, frustration tightening my throat. Another spreadsheet error – this time a miscalculated compound interest formula that vaporized $1,200 of imaginary returns. My hands smelled like stale coffee and desperation. That's when SMIFS Mutual Funds ambushed me through a finance podcast ad. Skeptical? Absolutely. But three days later, watching my fragmented Fidelity holdings, Vanguard IRAs, and even that forgotten Treasury bond material -

That Tuesday morning tasted like burnt coffee and regret. I'd fallen asleep watching Ethereum charts dance like manic fireflies, only to wake at 3 a.m. to a blood-red nosedive. My hands shook scrolling through three different exchanges - Binance’s labyrinth of tabs, Coinbase’s glacial load times, Kraken’s indecipherable order books. Each platform screamed conflicting data while my portfolio hemorrhaged value. I remember slamming my laptop shut, pixels blurring behind frustrated tears. Crypto was

That Tuesday morning tasted like burnt coffee and regret. I'd fallen asleep watching Ethereum charts dance like manic fireflies, only to wake at 3 a.m. to a blood-red nosedive. My hands shook scrolling through three different exchanges - Binance’s labyrinth of tabs, Coinbase’s glacial load times, Kraken’s indecipherable order books. Each platform screamed conflicting data while my portfolio hemorrhaged value. I remember slamming my laptop shut, pixels blurring behind frustrated tears. Crypto was -

The morning dew still clung to the grass when my phone vibrated violently against the wrought-iron bench. I’d been watching sparrows fight over crumbs, trying to forget the red arrows bleeding across global markets overnight. But there it was—AJ Bell’s push notification screaming that my energy stock had nosedived 14% before London even yawned awake. My thumbprint unlocked chaos: jagged crimson charts, frantic order books, and that sickening pit in my stomach when paper wealth evaporates. No Blo

The morning dew still clung to the grass when my phone vibrated violently against the wrought-iron bench. I’d been watching sparrows fight over crumbs, trying to forget the red arrows bleeding across global markets overnight. But there it was—AJ Bell’s push notification screaming that my energy stock had nosedived 14% before London even yawned awake. My thumbprint unlocked chaos: jagged crimson charts, frantic order books, and that sickening pit in my stomach when paper wealth evaporates. No Blo -

ApexTraderYou can use this appliance directly to the stock market of Mongolian stock exchanges or through Apex Capital NCH.\xc2\xa0Using this app:- Participate in securities trading online- Monitor cash balance- View your balance and account balance- View your package return calculations- Ask for money online* Please note that you must be a client of Apex Capital NEC to use this application and must sign up for a one-time contract at our office.

ApexTraderYou can use this appliance directly to the stock market of Mongolian stock exchanges or through Apex Capital NCH.\xc2\xa0Using this app:- Participate in securities trading online- Monitor cash balance- View your balance and account balance- View your package return calculations- Ask for money online* Please note that you must be a client of Apex Capital NEC to use this application and must sign up for a one-time contract at our office. -

M+ Mobile - Real-Time HK/US/CNAASTOCKS is the most authoritative financial information and analysis solutions provider in Hong Kong and has been well recognized by investors.Quote Services- Free Real-time HK Stock Quote- Real-time Streaming Teletext, Streaming Dual Quote Interface, Bid/Ask Queue & Brokers Queue- Real-time Technical Anaylsis with over 20 of most popular technical indicators- Real-time \xe2\x80\x9cMy Portfolio\xe2\x80\x9d \xe2\x80\x93 Real-time monitor all stocks within the portfo

M+ Mobile - Real-Time HK/US/CNAASTOCKS is the most authoritative financial information and analysis solutions provider in Hong Kong and has been well recognized by investors.Quote Services- Free Real-time HK Stock Quote- Real-time Streaming Teletext, Streaming Dual Quote Interface, Bid/Ask Queue & Brokers Queue- Real-time Technical Anaylsis with over 20 of most popular technical indicators- Real-time \xe2\x80\x9cMy Portfolio\xe2\x80\x9d \xe2\x80\x93 Real-time monitor all stocks within the portfo